I’m sick and tired of seeing PHEVs lumped together with EV sales in reports. It’s misleading and dilutes the focus on Battery Electric Vehicles (BEVs), which are the real future of transportation. While I can tolerate the Chinese breakdown of NEVs or the Canadian ZEV classification, they both carry shades of greenwashing, blurring the line between partial and full electrification. So, I thought it would be good to write a blog strictly dedicated to BEVs.

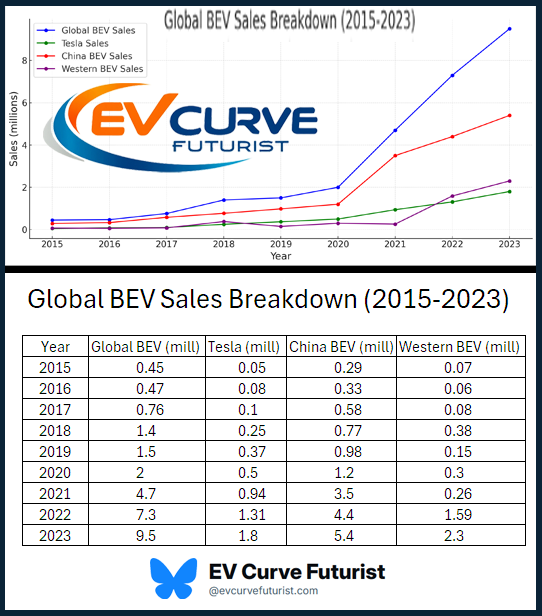

2024 will go down in history as a massive milestone when ICE sales started their inevitable decline and BEVs broke into the mainstream. This is a decline that won’t stop year-over-year until new ICE vehicle sales hit zero between 2030 and 2035. To provide clarity, I created a chart and data graph solely dedicated to BEV sales from 2015 to 2023, offering a breakdown by Tesla, China, and Western manufacturers. Adding to my frustration, I recently found myself stuck behind a Toyota RAV4 Hybrid in New South Wales, Australia, sporting EV-designated number plates—a completely absurd situation that epitomizes how misleading classifications dilute the focus on true BEVs. This incident highlights the pressing need for policy and regulatory changes to better differentiate BEVs from hybrids, ensuring clearer standards that align with the future of transportation.

The global Battery Electric Vehicle (BEV) market has experienced explosive growth over the past decade, rising from a mere 0.45 million units in 2015 to an impressive 9.5 million in 2023. While Tesla has been the poster child of the electric revolution, its dominance and near-monopoly in the early years are now increasingly overshadowed by the meteoric rise of Chinese manufacturers and a growing presence of Western competitors. This shift marks a critical turning point for the global EV landscape.

Tesla: From Pioneer to Player

Tesla’s rise to prominence in the BEV market is nothing short of revolutionary. However, its dominance began to shift significantly after the launch of the Model 3 and Model Y, which opened the doors for competitors to enter the growing market with alternative offerings. In 2015, the company sold approximately 50,000 vehicles, capturing a significant share of the fledgling market. By 2023, Tesla’s sales had soared to 1.8 million units. However, while Tesla’s absolute sales have grown exponentially, its share of the global BEV market has steadily declined, with 2024 set to continue this trend as Tesla’s market share drops further to 17% as of mid-2024:

- 2015: 11.1% market share

- 2020: 25% market share (peak dominance)

- 2023: 18.9% market share

Tesla’s reduced market share underscores its transition from a market monopolist to a major player in an increasingly competitive field. While Tesla’s innovative technology, brand equity, and global footprint remain formidable, the competition is catching up rapidly.

China: The New Powerhouse

China’s BEV market has grown at an unprecedented pace, driven by aggressive government policies, extensive subsidies, and rapid technological advancements. Additionally, China’s control over critical battery supply chains has given its automakers a unique edge in scaling production efficiently and cost-effectively. In 2015, China accounted for 0.29 million BEV sales, representing 64% of the global total. By 2023, this number had ballooned to 5.4 million, equating to 56.8% of global sales.

Key players in the Chinese market include:

- BYD Auto: With sales surpassing 1.6 million units in 2023, BYD has become a global leader in both BEV and plug-in hybrid segments.

- Geely Auto: As the second powerhouse in China behind BYD, Geely has rapidly expanded its BEV portfolio, including popular brands like Zeekr, which are gaining traction in global markets.

- SAIC-GM-Wuling: Known for affordable urban EVs like the Wuling Hongguang Mini, this joint venture sold nearly 500,000 BEVs in 2023.

- GAC Aion, Nio, and XPeng: These companies are pushing the boundaries of EV technology with advanced autonomous driving features and battery innovations.

China’s dominance is not merely a function of scale; it also reflects the country’s ability to deliver BEVs across all price points, from budget-friendly urban models to high-end luxury vehicles.

Western and South Korean Makers: A Resurgence

While Tesla led the charge for Western BEV makers, traditional automakers have begun to reclaim ground, aided significantly by government policies. Subsidies, tax incentives, and stricter emission standards in regions like the EU and US have spurred investments in electrification, enabling legacy automakers to accelerate their transition to BEVs. For example, the EU’s Fit for 55 program includes measures to reduce greenhouse gas emissions by 55% by 2030, heavily incentivizing BEV production. Similarly, the US Inflation Reduction Act provides significant tax credits for both manufacturers and consumers, fostering a favorable environment for BEV growth. By 2023, Western and South Korean manufacturers (excluding Tesla) sold 2.3 million BEVs, a significant increase from just 0.07 million in 2015.

Key contributors include:

- Volkswagen Group: Leveraging its MEB platform, Volkswagen sold nearly 460,000 BEVs in 2023, solidifying its position as one of the top Western BEV manufacturers. Its models, such as the ID.4, continue to perform strongly in key markets.

- Ford and General Motors: After what has been a horrendous two years for the OEMs, GM and Ford are finally starting to produce compelling EVs. Notably, the Chevrolet Equinox EV, nominated as Inside EVs’ Vehicle of the Year for its affordability, practicality, and range, represents a major milestone for GM. Notably, the Chevrolet Equinox EV, nominated as Inside EVs’ Vehicle of the Year for its affordability, practicality, and range, represents a major milestone for GM.

- Hyundai and Kia: South Korea’s EV giants have made strides with models like the Hyundai Ioniq 5 and Kia EV6, collectively selling nearly 500,000 units.

- BMW and Mercedes-Benz: German luxury brands are successfully electrifying their lineups, with combined sales exceeding 600,000 BEVs in 2023.

- Ford and General Motors: American stalwarts are ramping up their BEV production with models like the Ford Mustang Mach-E and GM’s Ultium-based vehicles.

The Big Takeaway: Economics Driving BEV Growth

The rise of BEVs is no accident. It reflects a confluence of market forces, consumer benefits, and technological advancements. While environmental concerns played a significant role in the early adoption of BEVs, today’s growth is largely propelled by economics and innovation, making BEVs the practical choice for millions.

Economic Drivers of BEV Growth

- Cost Savings: The lower total cost of ownership (TCO) of BEVs compared to ICE and PHEVs is undeniable. Fueling with electricity is cheaper than gasoline or diesel, and BEVs require significantly less maintenance.

- Affordability: Mass production and economies of scale have driven down BEV prices, making them competitive with ICE vehicles in many markets.

- Resale Value: BEVs are retaining their value better than ICE vehicles as demand grows and ICE bans loom.

- Innovation: Cutting-edge features like autonomous driving, over-the-air updates, and enhanced safety make BEVs an attractive option.

While environmental concerns played a significant role in the early adoption of BEVs, the primary driver of new BEV sales today is shifting to economics and market forces. Consumers are increasingly motivated by cost savings, convenience, and performance rather than purely climate-conscious decisions

Free market forces, such as increasing competition, advancements in battery technology, and reduced manufacturing costs, are accelerating BEV adoption globally. Governments initially incentivized BEVs to address climate change, but now, the market itself is propelling this shift. BEVs have become a practical and financially savvy choice for consumers, proving that economic benefits can drive a sustainable future.

The rise of BEVs is no accident. They offer a multitude of advantages over both Internal Combustion Engine (ICE) vehicles and Plug-in Hybrid Electric Vehicles (PHEVs), making them the future of transportation. Here’s why most drivers who transition to BEVs never look back:

Advantages Over ICE Vehicles

- Zero Tailpipe Emissions: BEVs produce no emissions during operation, significantly reducing air pollution.

- Lower Operating Costs: Charging a BEV is far cheaper than fueling an ICE vehicle, and maintenance costs are minimal due to fewer moving parts.

- Superior Driving Experience: Instant torque provides smooth acceleration, while quiet operation creates a serene cabin environment.

- Energy Efficiency: BEVs convert over 85% of electrical energy into motion, compared to only 25-30% for ICE vehicles.

- Regenerative Braking: BEVs recapture energy during braking, improving efficiency and reducing wear on brake pads.

- Future-Proof: With increasing regulations banning ICE vehicles, BEVs are a sustainable long-term solution.

Advantages Over PHEVs

- Simpler Design: BEVs avoid the complexity of an ICE engine, making them lighter and more reliable.

- Full EV Performance: Unlike PHEVs, BEVs rely solely on electric power, delivering superior range and performance.

- Cleaner Lifecycle: BEVs operate entirely on electricity, often sourced from renewables, unlike PHEVs that still burn fuel.

- Charging Support: Dedicated BEV fast chargers are more compatible and faster than those supporting PHEVs.

Why Drivers Won’t Go Back

BEVs offer substantial cost savings over their lifetimes compared to ICE and PHEV vehicles. For instance, a recent case study highlighted a family in California switching to a Tesla Model 3 from a gasoline-powered sedan. The family saved over $1,200 annually on fuel costs alone, thanks to charging primarily at home using solar energy. Additionally, their maintenance expenses dropped by 50%, with no oil changes or transmission repairs. Over five years, they estimated total savings exceeding $10,000, which underscored the financial practicality of BEVs beyond environmental benefits.

- Fuel Savings: Charging a BEV costs approximately $0.04 to $0.05 per mile, compared to $0.10 to $0.15 per mile for a gasoline-powered vehicle, resulting in savings of $3,000 to $4,000 annually for the average driver.

- Maintenance Savings: BEVs have fewer moving parts and no need for oil changes, timing belts, or exhaust repairs, saving owners an average of $300 to $500 per year on maintenance.

- Tax Incentives: In many regions, BEVs qualify for tax credits or rebates, which can reduce upfront costs by $2,500 to $7,500, depending on the country and model.

- Total Lifetime Savings: Over a 10-year period, BEV owners can save upwards of $20,000 to $30,000 compared to ICE vehicle owners, factoring in fuel, maintenance, and tax benefits.

- Convenience: Home charging eliminates the need for gas stations and saves time.

- Cost Savings: BEVs save thousands in fueling and maintenance costs over their lifetime.

- Advanced Tech: BEVs often feature cutting-edge software, autonomous driving capabilities, and over-the-air updates.

- Comfort: Features like preconditioning and smooth, silent rides make BEVs a pleasure to drive.

- Environmental Impact: Drivers feel good about reducing their carbon footprint and contributing to sustainability.

Tesla’s early dominance has been diluted by the dual forces of China’s scale and the resurgence of Western legacy automakers. Charging infrastructure advancements and consumer demand for lower prices have further encouraged a diversified market, accelerating the shift away from a Tesla-centric narrative. This trend underscores the significance of BEVs as the future of transportation, with Plug-in Hybrid Electric Vehicles (PHEVs) increasingly seen as a transitional step for those cautious about fully embracing BEVs amidst persistent FUD (fear, uncertainty, and doubt) from mainstream media and other sources. This fragmentation of the BEV market has several implications:

- Innovation Across the Board: With competition heating up, innovation is no longer Tesla’s sole domain. Companies like BYD are pioneering blade battery technology, while Volkswagen is focusing on scalable EV platforms.

- Price Pressure: The influx of Chinese BEVs into global markets, particularly Europe, is driving down prices, making EVs accessible to more consumers. This affordability is complemented by robust charging infrastructure in regions like Europe, helping to overcome one of the key adoption barriers.

- Geopolitical Shifts: China’s dominance raises questions about global supply chain dependencies, particularly for critical components like batteries.

- Policy-Driven Growth: Government incentives and regulations in regions like the EU and the US are accelerating the adoption of BEVs, benefiting local players.

What Lies Ahead?

The BEV market is poised for continued growth, with global sales projected to exceed 15 million units by 2025. Key trends to watch include:

- Tesla’s Strategy: As Tesla scales its production capacity (e.g., Gigafactories in Texas and Berlin), it aims to defend its market share through innovations like full self-driving (FSD), cost reductions via LFP batteries, robotaxis and new, more affordable models in addition to the updated Model Y.

- Chinese Exports: Chinese automakers are targeting international markets aggressively, with Europe as a key battleground but also actively penetrating South America, Africa, and Middle Asia markets, already starting to dominate in countries like Brazil, Mexico, Uruguay, and Thailand, to name but a few.

- Legacy Automakers’ Transition: Companies like Ford and Volkswagen are betting big on BEVs, aiming to electrify their fleets within the next decade. However, their reliance on Chinese battery and software partnerships highlights the global interdependence within the industry. Meanwhile, industry giants like Toyota and VW have turned to Chinese manufacturers for joint ventures, platform sharing, and software licensing, seeking to avoid being left behind in the dust of the rapidly advancing BEV market.

Conclusion

Tesla’s story remains one of incredible growth and innovation, but the days of unchallenged dominance are over. This is not a story of failure but a testament to how far the industry has come. Tesla’s early leadership sparked a global shift, proving that BEVs could outperform ICE vehicles in nearly every aspect. Now, with China’s unprecedented rise and legacy automakers regaining ground, the industry is witnessing a true revolution in transportation.

The shift underscores the significance of BEVs as the cornerstone of a sustainable future. PHEVs, while serving as a transitional step, are increasingly being left behind as consumers recognize the advantages of fully electric vehicles. The BEV revolution brings more than just environmental benefits—it heralds a future of technological innovation, economic savings, and global collaboration. For consumers, this means more choices, better technology, and lower prices. For Tesla, it means evolving from disruptor to competitor in a rapidly diversifying market. The age of BEVs isn’t just the next chapter in automotive history; it’s a pivotal moment in our fight against climate change and a transition to a cleaner, more sustainable world.

Looking ahead, the next big milestones for the BEV industry include achieving mass adoption in developing markets, breakthroughs in battery technology (such as solid-state batteries, LMFP, Sodium-Ion, LIS), and the establishment of global charging infrastructure parity with fossil fuel stations. These advancements will cement BEVs not only as the future of transportation but as a cornerstone of a sustainable global economy. This shift underscores the significance of BEVs as the future, while PHEVs increasingly serve as a transitional step for those cautious about fully embracing BEVs, often influenced by persistent FUD (fear, uncertainty, and doubt) from mainstream media and other sources. The rise of China’s BEV industry and the resurgence of Western automakers are reshaping the landscape. For consumers, this means more choices, better technology, and lower prices. For Tesla, it means evolving from disruptor to competitor in a rapidly diversifying market. The BEV revolution is no longer a one-company story—it’s a global phenomenon.