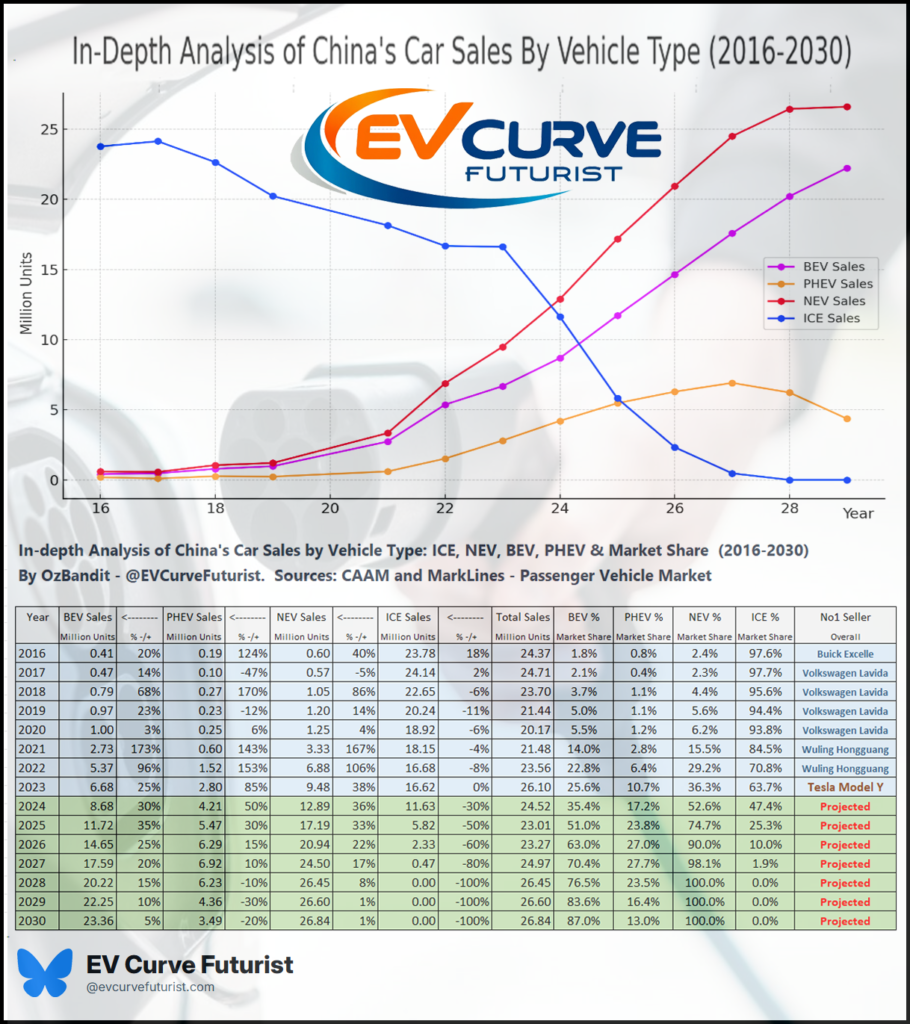

China’s New Energy Vehicle (NEV) market is on the fast track to total domination, with a clear trajectory: NEVs will account for 100% of new vehicle sales by 2028, and Battery Electric Vehicles (BEVs) will claim the entire market by 2030. This transformation is happening faster than most analysts predicted, driven by policies, innovation, and market dynamics that create a perfect storm of disruption.

My Projections for NEV and BEV Growth

- 2024: NEVs hit a critical tipping point, surpassing ICE vehicles with 52.6% market share (12.89 million units).

- 2026: NEVs capture over 80% of the market, while ICE vehicle sales fall below 3 million units.

- 2028: NEVs reach 100% market share, marking the end of ICE vehicle sales in China. BEVs dominate with 74% of the market (26.46 million units), and PHEVs fill the remaining 26%.

- 2030: BEVs achieve 100% market share, signaling the end of even transitional PHEVs.

These milestones represent a fundamental shift in China’s automotive market, driven by key factors that ensure the NEV revolution stays on track.

What Drives My Projections?

1. Government Policy Anchoring the Transition

China’s aggressive policy framework is the backbone of its NEV revolution. The government’s roadmap not only ensures compliance but actively incentivizes the rapid shift.

- NEV Mandates: Automakers must meet strict NEV production quotas through the dual credit system or face heavy penalties.

- ICE Ban Timeline: Sales of ICE vehicles will be phased out entirely by 2035, but by 2028, market forces will render ICE vehicles obsolete.

- Subsidy Phase-Out with Market Maturity: Generous subsidies that kickstarted the NEV market are being gradually replaced by demand-driven growth and economies of scale.

2. Cost Parity and Decline of ICE Viability

NEVs are rapidly outcompeting ICE vehicles on cost, even without subsidies.

- Battery Costs: LFP battery packs have fallen below $50/kWh, with further reductions expected as production scales and technologies like CATL’s sodium-ion batteries come online.

- Resale Value: The steep depreciation of ICE vehicles, driven by shrinking demand and future restrictions, deters new purchases.

3. Charging Infrastructure for Mass Adoption

China leads the world in charging infrastructure, removing one of the biggest barriers to NEV adoption.

- Urban and Rural Access: Over 5 million public and private charging points by 2024, with continued expansion into rural areas.

- Ultra-Fast Charging: Brands like Xpeng and Zeekr are delivering charging solutions that rival ICE refueling times, supporting mass-market adoption.

4. Consumer Preference for BEVs

The Chinese market is increasingly favoring BEVs over PHEVs, thanks to better performance, lower operating costs, and improved range.

- Technology Appeal: Advanced autonomous driving features and connected ecosystems make BEVs the preferred choice for tech-savvy buyers.

- Brand Innovation: BYD, Xpeng, Leapmotor, NIO, and Zeekr lead with high-quality, affordable BEVs, creating a global benchmark.

5. Domestic Automaker Dominance

China’s NEV ecosystem benefits from vertically integrated domestic automakers, reducing costs and accelerating innovation.

- BYD: As the top NEV producer, BYD’s integrated supply chain and innovations like the Blade Battery have set industry standards.

- NIO and Xpeng: These automakers are pushing boundaries with premium features, advanced driver-assistance systems, and energy-efficient designs.

Why 2028 and 2030 Are Key Milestones

The journey to 100% NEV adoption by 2028 and full BEV dominance by 2030 follows the classic S-curve of technology disruption. Initially, adoption appeared gradual, but once the market passed the tipping point in 2024, the pace of change accelerated exponentially.

- 2024-2026: This period marks the collapse of ICE vehicles as NEVs take over the majority of the market.

- 2027-2028: Transitional PHEVs remain viable but are quickly replaced by BEVs, which capture nearly all sales by 2028.

- 2029-2030: BEVs complete the takeover, marking the end of PHEVs as a transitional technology.

By 2030, the automotive market in China will be entirely electric—a transformation that cements its leadership in the global clean energy revolution.

Conclusion: The Numbers Tell the Story

China’s NEV revolution is more than a national success story—it’s a blueprint for how transformative policies, innovation, and market forces can reshape an industry. By 2028, the complete elimination of Internal Combustion Engine (ICE) vehicles from new sales will not just mark a milestone for China but serve as a wake-up call for global markets. And by 2030, as Battery Electric Vehicles (BEVs) reach 100% market share, China’s automotive market will stand as a testament to the power of disruptive innovation and decisive action.

Why China’s Success Matters Globally

China’s rise to 100% NEV and BEV adoption is not just about leading the world in electric vehicles—it’s about leading the world in climate action, economic transformation, and technological progress. Here’s why this matters:

- Global Climate Leadership: Transportation is one of the largest contributors to greenhouse gas emissions. By transitioning its entire new vehicle market to NEVs by 2028, China is significantly reducing its carbon footprint and setting an example for other nations to follow. This is a tangible step toward achieving global climate goals, including the commitments outlined in the Paris Agreement.

- Economic Transformation: The automotive industry is a cornerstone of China’s economy, and its shift to NEVs is creating entirely new value chains. From battery production and raw material refining to charging infrastructure and software ecosystems, the NEV revolution is generating millions of high-tech jobs and positioning China as the leader in a trillion-dollar global market.

- Technological Leadership: By achieving 100% BEV adoption by 2030, China will set a global benchmark for technology adoption. Chinese automakers are no longer merely competitors—they are innovators, outpacing legacy automakers in areas like fast-charging technology, energy efficiency, and autonomous driving. This leadership will influence the global market and redefine the automotive industry.

The S-Curve of Disruption: Lessons for the World

The rapid adoption of NEVs and BEVs in China underscores a fundamental truth: technological disruption is not linear. The S-curve of adoption shows that once a market reaches a tipping point, change accelerates exponentially. For China, that tipping point was in 2024, when NEVs captured more than half the market. The following years will see the complete phase-out of ICE vehicles, not because of regulation alone, but because the market itself has decided that NEVs—and eventually BEVs—are simply better.

Other nations and automakers must recognize that this transformation is inevitable. Legacy automakers clinging to ICE vehicle production risk irrelevance, while those investing in NEVs and infrastructure will thrive. The lesson is clear: to succeed in the automotive industry’s future, bold, forward-thinking action is required today.

China’s Role in Shaping a Sustainable Future

China’s NEV revolution goes beyond cars. It is part of a broader transition to a clean energy ecosystem powered by solar, wind, and battery storage. As BEVs become the dominant form of transportation, they integrate seamlessly into this ecosystem, using vehicle-to-grid (V2G) technology to stabilize the grid and accelerate the decarbonization of energy.

This holistic approach ensures that China’s leadership in NEVs is not just about dominating an industry but about driving a global shift toward sustainability. By 2030, China will not only be the world’s largest automotive market but also the most advanced, demonstrating how technology, policy, and innovation can work together to create a cleaner, greener future.

The Road Ahead: Scaling the Vision

China’s NEV journey doesn’t end in 2030. Beyond achieving 100% BEV adoption, the focus will shift to refining battery technologies, building even smarter vehicles, and exporting this success story to the rest of the world. With companies like BYD, NIO, and Xpeng already expanding their global presence, China’s NEV ecosystem is set to influence transportation trends worldwide.

As we look to the future, one thing is clear: the numbers tell a story of disruption, innovation, and transformation. China’s NEV revolution is not just a local phenomenon—it’s a global blueprint for a sustainable, electric future.