Disruption is a storm—it doesn’t just arrive, it reshapes everything in its path. And right now, EVs (electric vehicles) are the eye of this storm, revolutionizing the global automotive landscape faster than anyone anticipated. BEVs (battery electric vehicles) are on course to dominate global car sales by 2030. ICE (internal combustion engine) vehicles? Their collapse is accelerating at a pace few thought possible.

Why My Predictions Are Rooted in Reality

When I share my predictions about the rise of BEVs and the fall of ICE vehicles, many call them “too aggressive” or “unrealistic” and that’s putting it nicely. But disruption is rarely linear. It’s chaotic, driven by tipping points when technologies converge.

Take BEVs: they’ve already surpassed the 5% adoption threshold in most major markets—a critical milestone that marks the transition from early adopters to the mass market. History shows us this trajectory: from smartphones to digital cameras, once adoption gains momentum, change happens faster than anyone expects. ICE vehicles are no exception.

Norway is a prime example, with BEV sales surpassing 90% of the market in 2024. This rapid shift reflects how quickly tipping points accelerate change globally, especially as BEVs become the logical, economical choice.

The Cold Climate Myth: EVs Thrive in Winter

The claim that EVs underperform in cold climates has been completely dismantled, with Norway serving as the ultimate rebuttal. Despite experiencing some of the harshest winters in the world, Norway is on track to achieve nearly 100% EV adoption in new vehicle sales by the end of 2024. Here’s why cold weather is no longer a barrier for EVs:

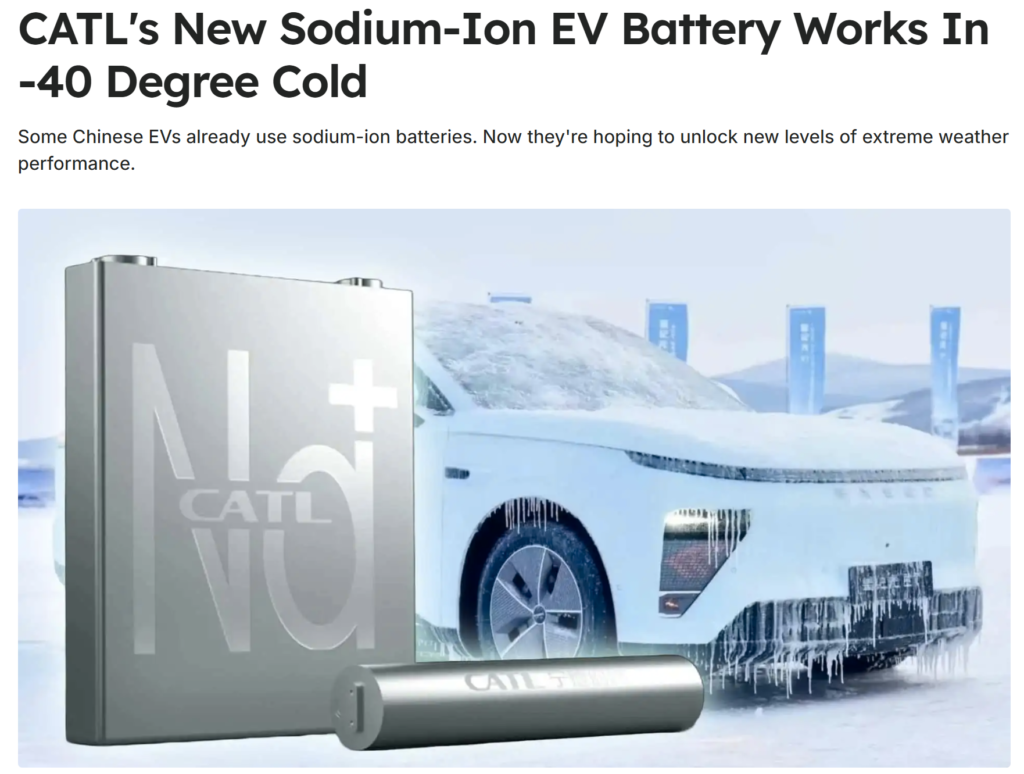

- Advanced Battery Technology: Modern EV batteries, especially those developed in China, deliver ranges of 600 to 1,000 km while incorporating thermal management systems to ensure optimal performance in freezing conditions. Emerging technologies like CATL’s sodium-ion batteries are taking this even further. These new batteries maintain excellent performance even in extreme temperatures as low as -20°C, paving the way for even greater reliability in cold climates.

- Charging Convenience: With home charging, drivers no longer need to endure freezing trips to petrol stations. The convenience of starting every day with a fully charged car eliminates range anxiety entirely, even during cold winter months.

- Winter Driving Efficiency: EVs excel in cold weather thanks to regenerative braking, which improves energy recovery and enhances control on icy roads. Unlike ICE vehicles, EVs often warm up faster thanks to efficient heat pump systems, improving both safety and comfort in cold conditions.

Meanwhile, Tesla’s ever-expanding Supercharger network, combined with the rapid rollout of third-party chargers, makes long-distance travel in cold regions seamless. Add to this the promise of new battery chemistries, such as CATL’s sodium-ion technology, which boasts affordability and durability in cold environments, and the so-called “tyranny of distance” argument crumbles under the weight of innovation and real-world EV performance.

What Makes ICE Collapse Inevitable?

A convergence of forces is driving ICE vehicles to the brink of collapse:

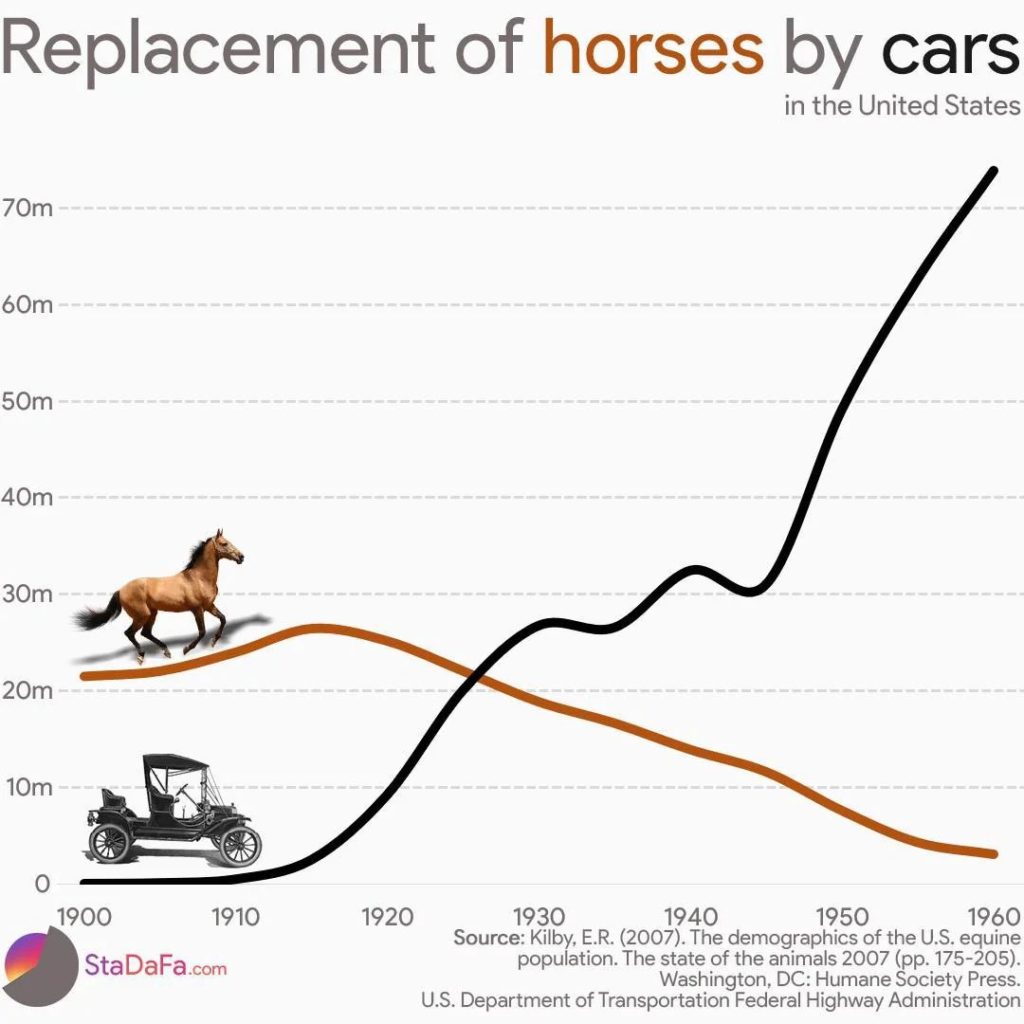

- Exponential Disruption: Disruption rarely follows a linear path—it accelerates rapidly, often catching legacy systems off guard. Just as automobiles replaced horse-drawn carriages in little more than a decade, BEVs are now poised to overtake ICE vehicles at a similar pace. This shift is driven by compounding forces like technological breakthroughs, consumer demand, and economic advantages that intensify as adoption grows.

- Peak Oil Demand: As BEVs rise and renewable energy systems expand, reliance on fossil fuels is plummeting, undermining the oil industry’s largest demand sector.

- Supply Chain Pressure: ICE manufacturers face shrinking economies of scale, rising costs, and geopolitical challenges, leaving them stretched thin.

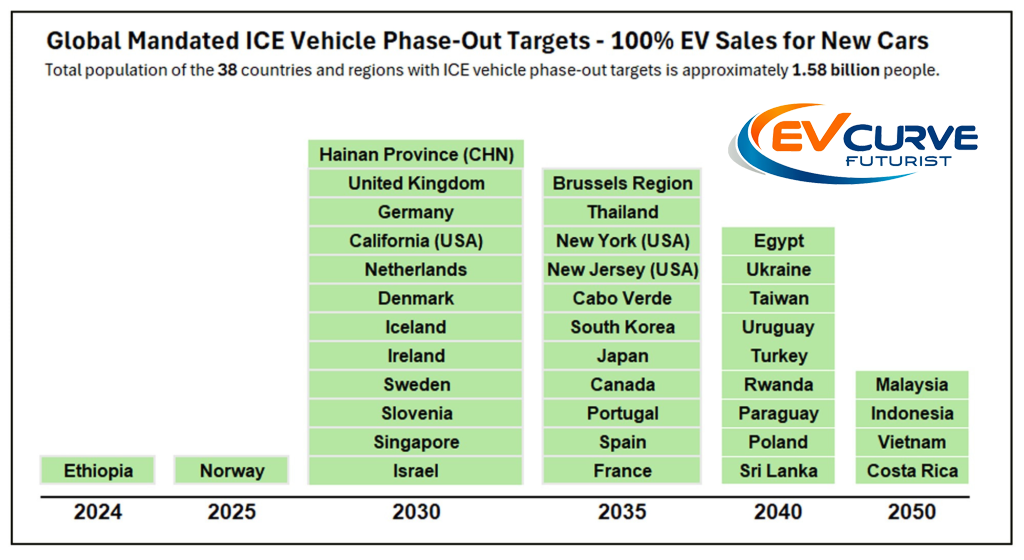

- Policy Tailwinds: Governments worldwide are implementing bans on ICE vehicles, boosting EV subsidies, and setting ambitious decarbonization goals. From the EU’s 2035 ICE ban to China’s NEV mandates, policies are pushing the transition globally.

- Developing Nations Leapfrogging Legacy Systems: Ethiopia’s 2024 ICE import ban is a striking example of how developing nations are bypassing legacy systems entirely. By opening the market to affordable EVs from companies like BYD, countries across Africa, Latin America, and Southeast Asia are becoming key players in the global EV shift. Regions like Thailand and Indonesia are heavily investing in EV infrastructure and manufacturing, positioning themselves as leaders in the new automotive era. These nations are not just passive adopters but active leaders, with governments and local industries leveraging the EV revolution to leapfrog traditional automotive paradigms. This shift is also fostering economic benefits, from reduced fuel import costs to the creation of green jobs in EV manufacturing and infrastructure development.

The Role of Affordability

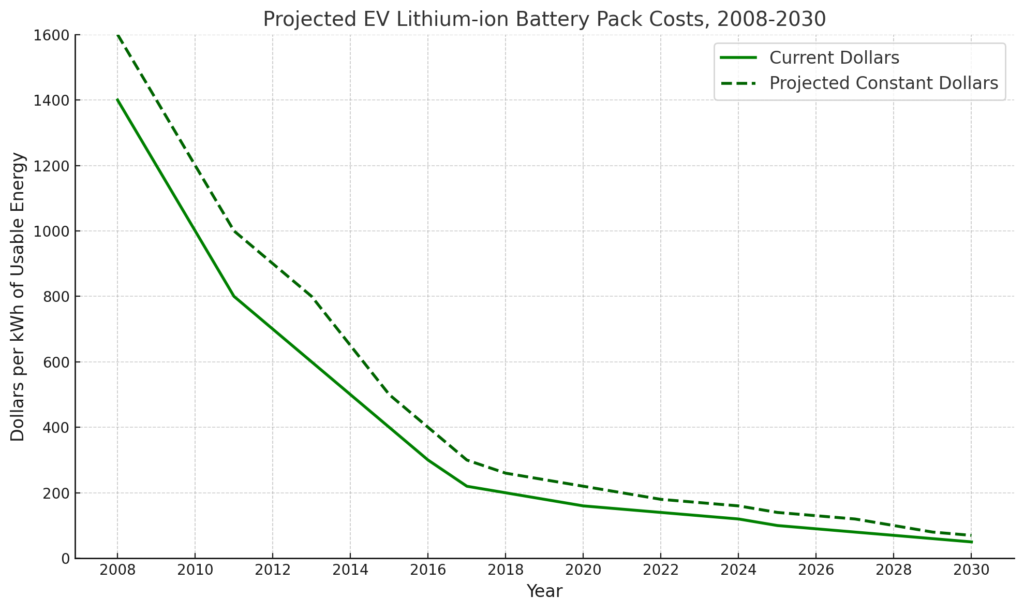

The shrinking price gap between ICE vehicles and BEVs is reshaping consumer choice globally. Thanks to plummeting battery prices—now as low as $50/kWh for LFP batteries—automakers can produce EVs that are not only cost-competitive but often cheaper than their ICE counterparts.

In Australia, this affordability revolution is clear. Small BEV hatchbacks like the GWM Ora (priced at $35,990 AUD driveaway) and the BYD Dolphin ($38,000 AUD) are undercutting ICE rivals like the Toyota Corolla and Hyundai i30. The MG4 Excite, at just under $40,000 AUD, offers superior technology and performance compared to similarly priced ICE vehicles.

This trend is accelerated by Australia’s proximity to China and the absence of import tariffs, but it reflects a global shift. In China, BEVs like the BYD Seagull cost as little as $10,000 USD, while in Europe, government incentives are narrowing the price gap. Across Latin America and Africa, affordable EV imports are allowing nations to leapfrog traditional automotive markets entirely.

Affordability Redefined

The financial advantages of BEVs go beyond upfront costs:

- Running Costs: BEVs save consumers thousands over their lifespan due to cheaper electricity and renewable energy options like home solar.

- Maintenance: With fewer moving parts, BEVs avoid expensive repairs such as oil changes and gearbox replacements.

- Longevity: Modern batteries, particularly LFP variants, last up to 1 million kilometers, providing exceptional value.

As BEVs become the financially logical choice for consumers worldwide, the economic rationale for ICE vehicles continues to erode.

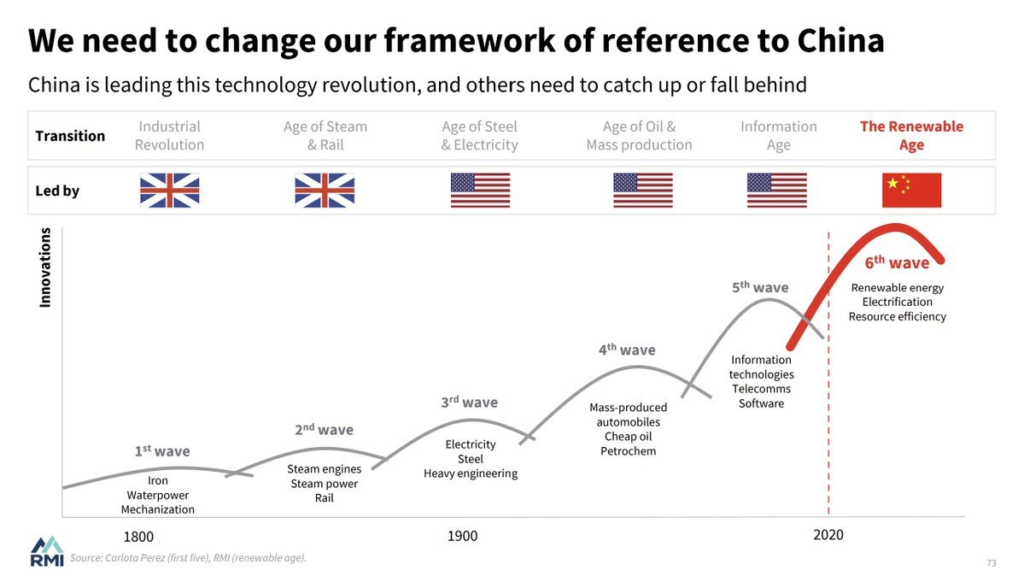

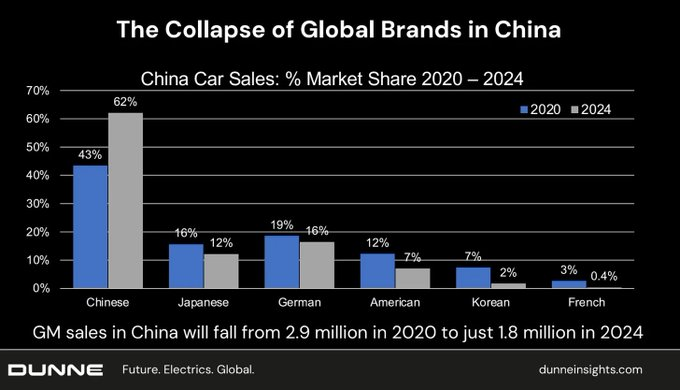

The Rise of China: The EV Juggernaut Redefining Global Markets

China has emerged as the undisputed leader in the EV revolution, scaling production, technology, and global influence faster than anyone anticipated. Once dismissed by global competitors for its lack of experience, China has now reshaped the automotive industry, driving adoption trends and consumption patterns worldwide.

From Underdog to Market Leader

While skeptics mocked their early EV efforts, Chinese automakers focused on scaling production, perfecting supply chains, and advancing battery technology. The results are undeniable:

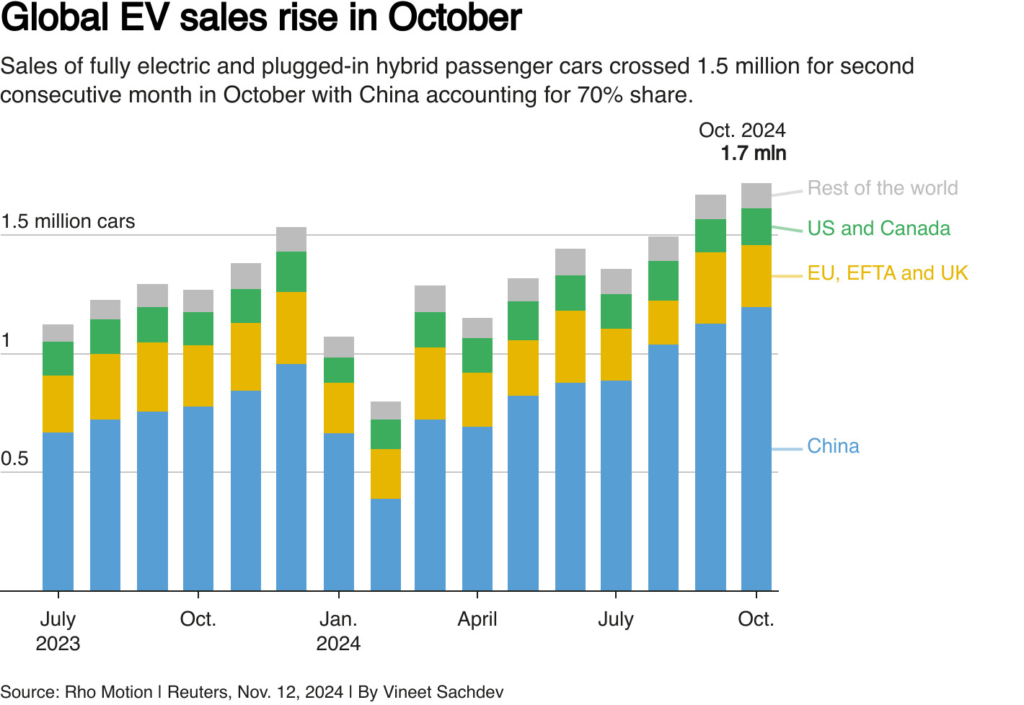

- By 2024, two-thirds of the world’s EVs were manufactured in China.

- China became the number one car exporter globally, surpassing Japan and Germany.

- Over 50% of new car sales in China were NEVs, with the nation on track for 100% NEV adoption by 2028 and full BEV dominance by 2030.

Innovation Meets Affordability

Chinese automakers like BYD, NIO, Xpeng, and Geely have leveraged economies of scale to produce affordable, high-performance EVs.

- The BYD Dolphin, priced at $38,000 AUD, challenges ICE rivals like the Toyota Corolla.

- The BYD Seagull, at just $10,000 USD, showcases the affordability possible when scale meets innovation.

- Models from Leapmotor and Zeekr, with charging speeds exceeding 500 kW, are setting new performance benchmarks.

Global Reach and Influence

China’s EV dominance isn’t limited to domestic success—it’s reshaping global markets:

Australia: Without import tariffs, models like the GWM Ora and BYD Dolphin are undercutting legacy ICE cars, demonstrating the global ripple effects of China’s production capacity.ends. With every vehicle sold, China’s trajectory cements its role as the driving force behind the EV revolution.

Europe: Chinese brands are rapidly gaining market share, offering well-equipped EVs at prices legacy automakers struggle to match.

Developing Nations: Affordable Chinese EVs are enabling regions like Africa and Latin America to leapfrog ICE vehicles entirely.

A Strategic Vision for the Future

China’s rise isn’t accidental—it reflects deliberate investments in EV infrastructure, government subsidies, and renewable energy. Chinese automakers are shaping the EV market, setting global trends in affordability, battery technology, and manufacturing innovation.

As the world accelerates toward electrification, China’s leadership will continue to define the pace and trajectory of the EV revolution.

Ripple Effects: How the EV Revolution Is Reshaping Economies

- Oil Industry Disruption: Peak oil demand, driven by the rise of BEVs, threatens to strand billions of dollars in oil assets. Major oil companies are pivoting to renewables in a bid to survive.

- Battery Supply Chain Expansion: The surging demand for BEVs is creating unprecedented growth in the battery supply chain. Lithium, nickel, and cobalt are at the heart of this expansion, with companies racing to secure resources and scale production. Breakthroughs in battery chemistry, like LFP (lithium iron phosphate), are reducing costs and increasing supply security.

- Traditional Auto Manufacturing: Legacy automakers face extinction if they fail to adapt quickly to the BEV shift, as their ICE-based economies of scale collapse.

- Consumer Behavior Shift: Buyers now prioritize lower running costs, reduced maintenance, and advanced technology, making EVs the clear winner.

- Market Dynamics: Tesla’s Model Y, the world’s best-selling car in 2023 (not just among EVs, but across all vehicle types), marks the tipping point in consumer adoption. This milestone, set to repeat in 2024, signals the accelerating decline of ICE vehicles globally and validates BEVs as the dominant choice for consumers, forcing legacy automakers to accelerate their EV strategies.

- V2G Technology: By turning EVs into mobile power units, V2G bidirectional charging technology is not just reshaping personal transportation but also enabling a decentralized energy grid, making electricity more reliable during peak demands.

Technological Advancements Driving EV Adoption

Innovations in EV technology are eliminating the final barriers to adoption:

- Fast Charging: Speeds of 500 kW or more enable a full charge in under 10 minutes, addressing range anxiety.

- Battery Innovations and Cost Decline: Over the past decade, battery pack prices have dropped by more than 85%, falling from around $1,200 per kWh in 2010 to under $150 per kWh in 2024. Some battery technologies, such as LFP (lithium iron phosphate), are already below $50 per kWh, making BEVs cheaper to produce than ICE vehicles in many segments. This dramatic reduction in battery costs is a key driver of affordability, enabling automakers to launch models like the $10,000 BYD Seagull, which combines affordability with advanced features.

- Bidirectional Charging: V2G technology allows EV owners to sell excess power back to the grid, turning EVs into mobile energy assets.

- Autonomous Driving: As autonomous technologies mature, EVs will integrate seamlessly into transport-as-a-service (TaaS) ecosystems, further reducing costs and increasing convenience for consumers.

- Wireless Charging: Emerging technologies like wireless charging promise even greater convenience, paving the way for EVs to become an integral part of smart cities.

- AI and Predictive Maintenance: AI-powered systems in EVs offer predictive maintenance, improving reliability and reducing long-term ownership costs.

The Road Ahead – Challenges to Address

While the transition is inevitable, challenges remain:

- Infrastructure Bottlenecks: In some regions, the deployment of charging stations is lagging behind the pace of EV adoption. Governments and private companies must accelerate infrastructure investment.

- Grid Capacity: The surge in EVs will require grids to handle increased electricity demand. Smart grids, coupled with renewable energy, are key to ensuring stability.

- Resistance from Legacy Industries: Fossil fuel companies and traditional automakers may resist the transition, lobbying for policies that slow down progress. However, history shows resistance only delays—not stops—disruption. Misinformation campaigns and lobbying may create temporary hurdles but cannot reverse the course of change.

Energy Efficiency: The Undeniable Advantage of BEVs

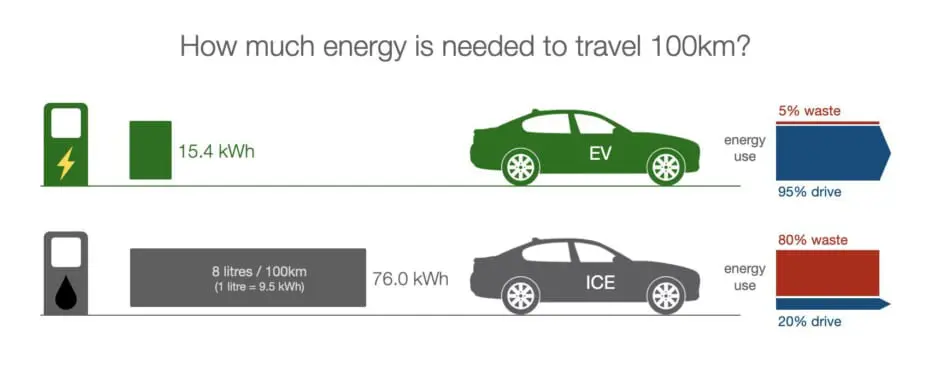

One of the most compelling advantages of BEVs is their unparalleled energy efficiency. On average, BEVs use 15.4 kWh of energy to travel 100 km, while ICE vehicles burn the equivalent of 76.0 kWh of energy for the same distance—more than 80% of which is wasted as heat, friction, and noise. In contrast, BEVs convert over 90-95% of the energy from the battery into motion.

This isn’t just an engineering marvel; it’s a game-changing shift in how we use energy. Imagine the scale of global energy savings when millions of BEVs replace ICE vehicles on the road. The ripple effects extend beyond efficiency—less energy consumption means fewer emissions, lower energy costs, and reduced strain on infrastructure.

ICE Manufacturing: A System in Decline

The complexity of internal combustion engine (ICE) vehicles is one of their greatest weaknesses in the face of electrification. ICE cars are over-engineered mechanical machines, with more than 600 moving parts that must work in unison for the vehicle to function. This intricate design not only makes ICE vehicles prone to wear and tear but also drives up manufacturing costs significantly. Each part adds to production complexity, supply chain vulnerabilities, and maintenance headaches for consumers.

Key challenges facing ICE manufacturing include:

- Shrinking Profit Margins: ICE automakers are grappling with rising costs from maintaining legacy systems and tooling, while production volumes shrink, eroding economies of scale.

Stricter emissions standards further increase production expenses, making the economic model for ICE manufacturing unsustainable.

- Manufacturing Complexity: The sheer number of components—over 600 moving parts—makes ICE vehicles inherently expensive to produce. This complexity leads to higher assembly times, increased material costs, and greater supply chain vulnerabilities.

- High Maintenance Costs: Consumers face ongoing expenses from oil changes, exhaust repairs, and multi-speed transmissions, adding to the long-term ownership costs of ICE vehicles.

In contrast, EVs are models of simplicity with only around 20 moving parts, offering significant advantages:

- Lower Manufacturing Costs: Fewer components result in shorter assembly times and reduced material costs, making EVs far more economical to produce.

- Streamlined Supply Chains: EV makers like Tesla and BYD use vertical integration, controlling everything from batteries to software, cutting costs and eliminating bottlenecks.

- Minimal Maintenance: EVs require no oil changes, exhaust systems, or complex transmissions, reducing ownership costs significantly.

By 2030, as economies of scale continue to drive EV prices lower, ICE vehicles will not just struggle—they will become economically unfeasible relics. At that point, the cost of purchasing a new ICE vehicle will easily be double, if not triple, the price of an EV.

The outdated complexity of ICE cars, combined with skyrocketing production costs and declining demand, will render them obsolete in a market dominated by efficient, affordable EVs. The automotive industry isn’t just transitioning—it’s undergoing a revolution, and ICE manufacturing is on borrowed time.

Costs: The Inevitable Economic Shift to EVs

The economic dynamics of owning and operating an EV are decisively shifting, making internal combustion engine (ICE) vehicles a relic of the past. Battery replacement costs, long a sticking point for skeptics, are falling rapidly. As noted by InsideEVs, replacing an EV battery is now frequently cheaper than repairing or replacing an ICE engine. Add to this the incredible longevity of modern batteries—lasting over 1 million km while retaining 80-90% of their original charge—and the financial advantages of EV ownership become undeniable.

By 2030, the cost disparity between ICE vehicles and EVs will not just grow—it will become insurmountable. This inevitability is driven by a perfect storm of economic pressures:

- Stricter emissions regulations: Increasingly aggressive policies demand expensive technology upgrades for ICE vehicles.

- Reduced economies of scale: As EVs dominate the market, shrinking production volumes for ICE vehicles will drive up per-unit costs.

- Volatile fuel prices: Petrol and diesel costs will remain unpredictable, with a long-term upward trend, further eroding the appeal of ICE vehicles.

Insurance premiums will also surge for non-autonomous, fossil-fueled vehicles, as the industry recognizes the heightened risk and inefficiency compared to EVs. Consumers globally, are pragmatic. As ICE vehicles become an economically unviable choice, the transition to EVs will not be a matter of preference—it will be a financial necessity.

From Niche to Dominance — My Numbers Tell the Story

The rapid transformation of the automotive industry is undeniable, as highlighted by the meteoric rise of Battery Electric Vehicles (BEVs). In 2016, BEVs made up just 0.7% of global car sales, with 0.47 million units sold. By 2024, they are projected to reach 20% of the global market, with annual sales exceeding 12 million units, signaling the next tipping point for mass adoption.

Both my projections and those of RethinkX align on this unprecedented S-curve trajectory of disruption. By 2027, BEVs are set to overtake ICE vehicles entirely, capturing 54 % of global market share with 27 million units sold annually, while ICE sales plummet. By 2030, BEVs will dominate with an astonishing 96 % of total car sales, accounting for 52 million units annually, while ICE vehicles cling to a dwindling 2% market share.

The transition isn’t linear—it’s disruptive. As RethinkX highlights, the shift to BEVs will follow the classic S-curve of technology adoption, where change seems slow at first but accelerates rapidly once the tipping point is reached. By 2030, ICE vehicles will no longer compete, as BEVs become the default choice for consumers, driven by their cost advantages, reliability, and a global ecosystem designed to support them.

The Imminent Collapse of ICE and the EV Revolution

This is disruption in its rawest form—messy, chaotic, and unstoppable. As the automotive landscape undergoes a transformation, those who adapt and embrace the change will thrive, while those who cling to the past risk irrelevance.

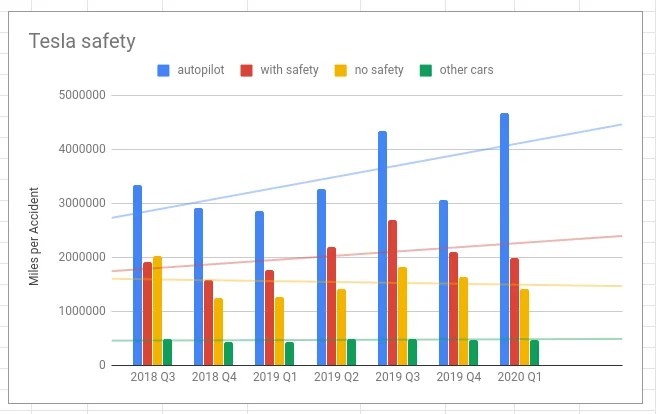

Tesla’s role in this revolution cannot be overlooked. As a pioneer, Tesla has redefined what EVs can achieve—combining cutting-edge battery technology, vertical integration, and market-shaping innovation. The success of vehicles like the Model Y, now the world’s best-selling car, demonstrates how rapidly the shift to EVs is happening. Tesla’s achievements have forced legacy automakers to rethink their strategies, sparking a race to electrify at unprecedented speeds.

By 2035, ICE vehicles will no longer be the dominant force on our roads. They’ll remain as relics of a past era, while BEVs, driven by technological innovation, affordability, and consumer demand, take center stage. The environmental and economic ripple effects of this transition are already reshaping industries, creating new opportunities, and accelerating the global push toward sustainability.

For governments, businesses, and individuals, the choice is clear: adapt to the EV revolution or be left behind as the world races toward a cleaner, more efficient future. The road to change is already underway.

The only question is—will you embrace the EV future, or get stuck in reverse? Tesla and others are already leading the charge. The EV revolution is not just about vehicles—it’s about rethinking energy, sustainability, and the economy itself. For governments, businesses, and individuals. The time to act is now or risk getting stuck in reverse.

Sources and Insights

Below are my sources and research points. Note that only RethinkX aligns with my 2030 projections. History will prove who’s right soon enough—enjoy! 🙂

RethinkX

Rethinking Transportation 2020-2030: The Disruption of Transportation and the Collapse of the Internal Combustion Vehicle and Oil Industries explores the rapid transition to EVs and its societal impact:

https://www.rethinkx.com/transportation

Rho Motion

Detailed reports on EV sales, battery trends, and charging infrastructure:

https://rhomotion.com/research/ev-sales-monthly-assessment

Dunne Insights

Expert knowledge on global EV and autonomous vehicle markets:

https://www.dunneinsights.com

International Energy Agency (IEA)

Global EV Outlook 2024 with key trends in EV adoption and policy impacts:

https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

BloombergNEF (BNEF)

Electric Vehicle Outlook 2024 with projections on electrification:

https://about.bnef.com/electric-vehicle-outlook

Mordor Intelligence

Analysis of global EV market growth and trends:

https://www.mordorintelligence.com/industry-reports/electric-vehicle-market

Fortune Business Insights

Market size and forecast analysis for electric vehicles:

https://www.fortunebusinessinsights.com/industry-reports/electric-vehicle-market-101678

Statista

Comprehensive data on China’s EV market dynamics:

https://www.statista.com/topics/1010/electric-mobility

Our World in Data

Global EV adoption rates and data:

https://ourworldindata.org/electric-car-sales

Grand View Research

Forward-looking EV trends up to 2030:

https://www.grandviewresearch.com/industry-analysis/electric-vehicles-ev-market

Deloitte Insights

EV market segmentation and growth opportunities:

https://www2.deloitte.com/content/dam/insights/us/articles/22869-electric-vehicles/DI_Electric-Vehicles.pdf