Chinese automakers are setting their sights on South America as a lucrative destination for expansion and as a solution to address their burgeoning production overcapacity. With the rapid growth of EV adoption globally, South America’s untapped potential, coupled with its increasing appetite for electric vehicles, makes it a strategic market for Chinese companies to dominate. This blog explores the reasons behind this shift, the strategies employed by Chinese automakers, and the key players driving this expansion.

Overcapacity in China’s EV Industry

China’s EV market is the largest in the world, accounting for more than 50% of global EV sales. However, the domestic market is beginning to mature, with fierce competition among hundreds of EV brands and a gradual slowing of adoption rates. The result is overcapacity in the production of EVs, especially as automakers ramped up output to meet previously surging demand.

To avoid inefficiencies and financial losses, Chinese automakers are increasingly turning their attention overseas. South America, with its combination of underdeveloped EV markets and a growing interest in sustainable mobility solutions, presents a golden opportunity for expansion.

Why South America?

1. Untapped Market Potential

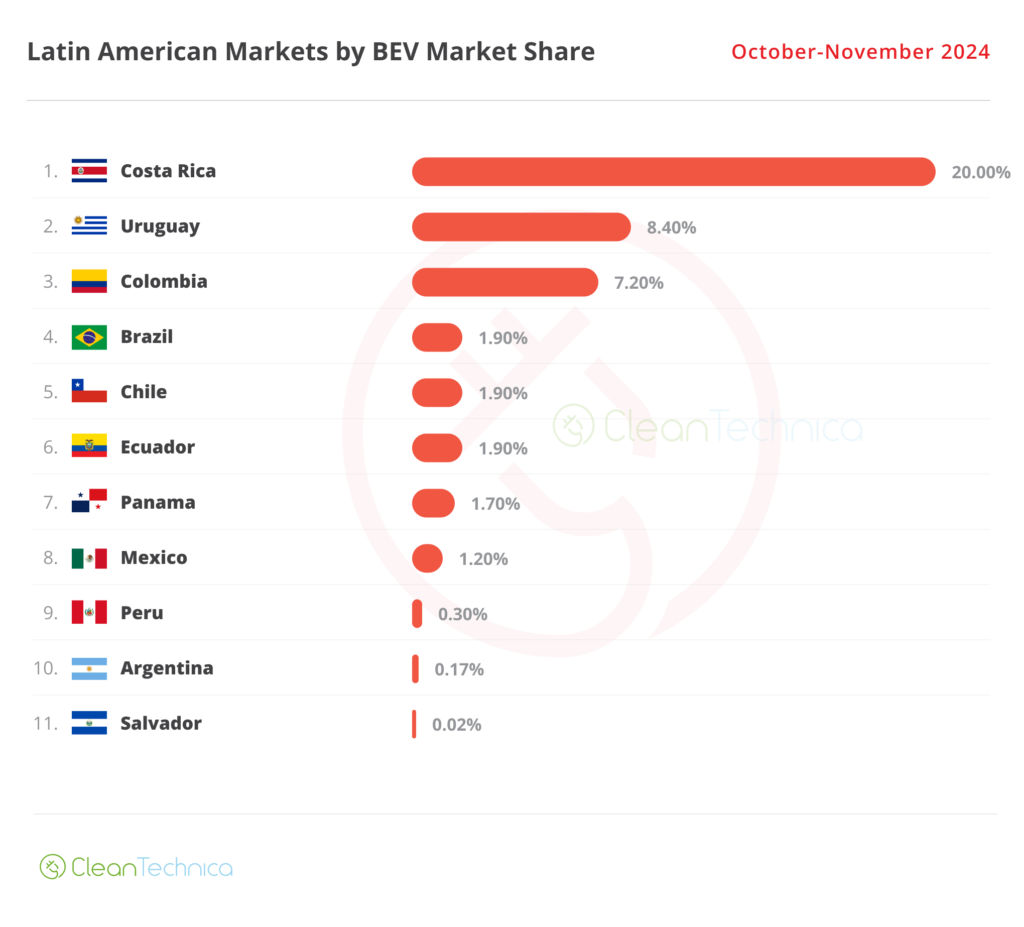

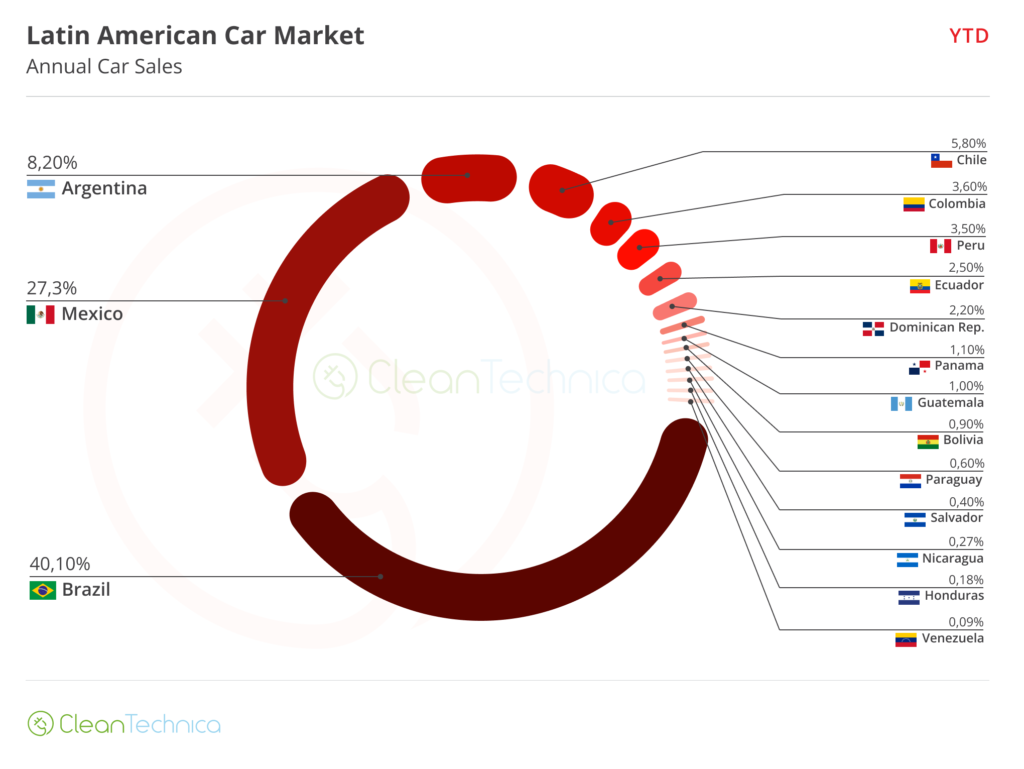

While countries like Brazil, Uruguay, and Colombia have made progress in EV adoption, the majority of South America still lags far behind global averages. For instance, in 2023, Argentina’s battery electric vehicle (BEV) sales accounted for only 0.08% of total vehicle sales. Similarly, Peru’s plug-in vehicle market share was just 0.3%.

Chinese automakers see this untapped market as fertile ground for affordable EVs, particularly given the lack of strong local competition. By entering early, they can establish brand loyalty and secure long-term dominance.

2. Price Sensitivity and Demand for Affordable EVs

South American consumers are highly price-sensitive, making the region less appealing to premium EV brands like Tesla. Chinese automakers, however, are well-positioned to meet this demand with their competitively priced vehicles. Models like BYD’s Dolphin and Atto 3 offer advanced technology at a fraction of the cost of Western counterparts.

3. Favorable Trade and Investment Environment

China’s strong economic ties with South America, bolstered by trade agreements and infrastructure investments, provide a smooth pathway for EV exports. Additionally, Chinese investment in the region’s lithium resources – critical for battery production – strengthens the supply chain and reduces costs for EV production and distribution.

Lithium Mining and Refining: Building a Supply Chain

South America’s lithium resources, concentrated in the “Lithium Triangle” of Argentina, Bolivia, and Chile, are vital to the global EV supply chain. Recognizing this, Chinese companies are heavily investing in lithium mining and refining operations across the region.

- Chinese Investments in Lithium Mining: Companies like Ganfeng Lithium and Tianqi Lithium have secured stakes in major South American lithium projects, ensuring a steady supply of the critical mineral for battery production.

- Vertical Integration: By integrating mining and refining processes, Chinese firms aim to reduce costs and control the supply chain, making their EV offerings even more competitive.

- Strategic Partnerships: Collaborations between Chinese firms and local governments have led to the development of new lithium extraction technologies, such as Direct Lithium Extraction (DLE), which promise higher efficiency and lower environmental impact.

These moves not only secure China’s position in the global EV race but also strengthen its ability to meet growing demand in South America and beyond.

Environmental Impact and Sustainability Initiatives

As the demand for lithium mining and EV production grows, environmental concerns become a critical issue. Chinese firms are taking steps to address these challenges:

- Eco-Friendly Technologies: Newer technologies like Direct Lithium Extraction (DLE) reduce water usage and environmental degradation compared to traditional methods.

- Local Collaboration: Partnerships with South American governments aim to ensure mining operations comply with environmental regulations and benefit local communities.

- Recycling Initiatives: Chinese automakers are investing in battery recycling plants to ensure sustainable lifecycle management of EV batteries.

South American Workforce Development

The expansion of Chinese automakers in South America is creating jobs and fostering skill development in the region. Investments include:

- Training Programs: Chinese firms are working with local institutions to train workers in EV manufacturing, battery assembly, and charging infrastructure maintenance.

- Job Creation: New assembly plants and lithium refineries are expected to provide thousands of direct and indirect employment opportunities.

- Technology Transfer: By operating locally, Chinese companies are introducing advanced technologies, helping to modernize South America’s automotive and mining industries.

Potential Risks and Challenges

Despite the opportunities, several risks could impact the success of Chinese automakers in South America:

- Geopolitical Tensions: As Chinese investments increase, there may be pushback from other nations or local groups wary of foreign influence.

- Regulatory Hurdles: Navigating the diverse regulatory landscapes of South American countries requires careful strategy and adaptation.

- Environmental Concerns: Without careful management, mining and production activities could face opposition from environmental groups and local communities.

Role of Other Nations

While China leads in investments, other nations are also eyeing South America’s EV potential:

- Europe: European automakers like Volkswagen and Renault are beginning to introduce affordable EVs to compete with Chinese offerings.

- United States: Companies like Tesla and GM are exploring opportunities, though their focus remains limited compared to China.

- Japan and Korea: Automakers like Toyota and Hyundai are slow to enter the market but may ramp up efforts as demand grows.

Consumer Adoption Trends

South American consumers are gradually warming up to EVs, driven by increasing affordability and improved infrastructure:

- Shift in Preferences: Affordable Chinese EVs are appealing to first-time buyers who prioritize cost over luxury.

- Incentives: Government subsidies and tax breaks are making EV ownership more accessible.

- Infrastructure Growth: Expanding charging networks, including the regional EV recharging corridor, are alleviating range anxiety.

Key Chinese Players Expanding in South America

BYD

BYD is the undisputed leader among Chinese automakers in South America. With a comprehensive portfolio of BEVs and plug-in hybrid electric vehicles (PHEVs), BYD has rapidly gained market share in countries like Brazil, Colombia, and Uruguay. Notably:

- In Uruguay, BYD holds 70% of the EV market share, driven by its competitive pricing and versatile lineup.

- BYD has established manufacturing facilities in Brazil, producing both electric buses and passenger vehicles locally. This strategy not only reduces costs but also aligns with local regulations and incentives.

- The company’s focus on PHEVs allows it to cater to markets where charging infrastructure is still developing, ensuring broader consumer appeal.

Chery

Chery, a well-known Chinese automaker, is aggressively expanding its presence in South America. Leveraging its reputation for affordability and reliability, Chery is introducing EVs that cater to middle-class consumers.

- Chery’s popular hybrid and fully electric models, such as the eQ1, have seen growing adoption in markets like Ecuador and Chile.

- The company is also exploring partnerships for local assembly to reduce import tariffs and improve market penetration.

Great Wall Motors (GWM)

Great Wall Motors has entered the South American market with its ORA brand, which specializes in compact and affordable EVs. GWM’s focus on stylish, tech-forward designs appeals to younger, urban consumers.

- In Argentina and Peru, GWM is building its distribution networks, targeting urban centers where demand for small, efficient EVs is on the rise.

- The company’s push into South America aligns with its broader global strategy of achieving significant export growth.

Geely

Geely, another major player, has made inroads into South America with its high-quality EV offerings. Known for its advanced technology and focus on safety, Geely is carving out a niche in more premium segments compared to BYD and Chery.

- Geely’s focus on Chile and Brazil includes partnerships with local dealerships to enhance customer support and after-sales service.

- The company’s success in other global markets provides a strong foundation for its South American ambitions.

SAIC Motor (MG Motors)

SAIC’s MG brand has been gaining popularity in South America, thanks to its competitive pricing and strong branding. The MG ZS EV, a small electric SUV, has performed particularly well in markets like Colombia and Panama.

- MG is actively investing in charging infrastructure partnerships, which helps alleviate consumer concerns about range and accessibility.

- The brand’s affordable pricing strategy positions it as a strong contender against both Chinese and Western competitors.

Zeekr

Zeekr, a premium EV brand under Geely, has also set its sights on South America. Known for its luxury designs and advanced technology, Zeekr is targeting affluent consumers in urban areas.

- Zeekr plans to launch its flagship models in markets like Chile and Brazil, leveraging Geely’s existing dealership networks.

- The brand aims to position itself as a luxury alternative to Western EV makers, appealing to tech-savvy and environmentally conscious buyers.

Xpeng and Leapmotor

Xpeng and Leapmotor, two of China’s fastest-growing EV brands, are also exploring opportunities in South America:

- Xpeng: Known for its high-tech features, such as advanced driver-assistance systems (ADAS), Xpeng is reportedly in talks to enter markets like Brazil and Colombia, focusing on urban areas where its smart EVs can stand out.

- Leapmotor: With its compact, affordable EVs, Leapmotor is well-suited to South America’s price-sensitive markets. The brand is eyeing expansion into Ecuador and Peru, targeting first-time EV buyers.

Strategic Moves and Long-Term Goals

Localized Production

To overcome import tariffs and further reduce costs, Chinese automakers are setting up assembly plants in South America. BYD’s factory in Brazil is a prime example of this strategy, enabling the company to expand while adhering to local content regulations.

Charging Infrastructure Development

Chinese companies are investing heavily in charging networks to support their EV sales. For instance, BYD and GWM have partnered with local governments and private entities to roll out charging stations across urban and suburban areas.

This effort is further bolstered by the announcement of a regional EV recharging corridor, spearheaded by countries like Mexico, Colombia, and Panama, in collaboration with other Latin American nations. This ambitious project aims to connect major cities with a seamless network of charging stations, facilitating long-distance travel for EVs across borders. Such infrastructure not only supports local EV markets but also aligns with the long-term vision of Chinese automakers to establish South America as a key destination for EV expansion.

Government Incentives and Policies

Chinese automakers are benefiting from South American governments’ push for greener transportation. Countries like Uruguay and Panama have introduced tax breaks, subsidies, and other incentives to promote EV adoption, aligning with China’s export ambitions.

The Bigger Picture: A Win-Win Scenario?

For South America, the influx of affordable EVs from China accelerates the region’s transition to sustainable mobility. It also brings much-needed investments in infrastructure and technology, creating jobs and reducing carbon emissions.

For China, South America represents a strategic outlet for overcapacity while solidifying its position as a global leader in the EV industry. By establishing dominance in emerging markets, Chinese automakers are setting the stage for long-term growth and profitability.

Conclusion

South America’s EV market is at a turning point, and Chinese automakers are leading the charge. With their competitive pricing, aggressive expansion strategies, and investments in infrastructure, companies like BYD, Chery, GWM, Geely, SAIC, Zeekr, Xpeng, and Leapmotor are reshaping the automotive landscape across the continent. The integration of lithium mining and refining operations strengthens China’s control over the EV supply chain, while initiatives like the EV recharging corridor further enhance the market’s appeal. Additionally, workforce development, sustainability efforts, and attention to local regulations underscore the multifaceted approach needed to secure this emerging frontier. As this trend continues, Chinese brands are poised to emerge as dominant players.