What happens when a disruptive technology becomes a global phenomenon? The answer: industries are transformed, geopolitics shift, and growth accelerates faster than anyone anticipates!

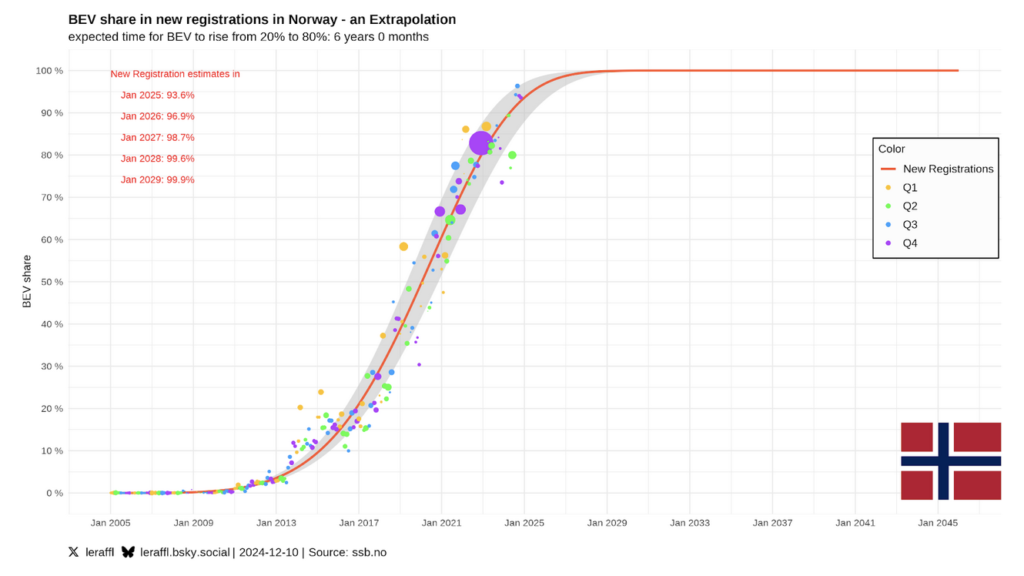

When discussing the electrification of global transportation, the Norwegian model of EV adoption is often considered the gold standard. Norway transitioned from 20% to 80% BEV sales in just five years and is on track to reach 100% by 2025. However, Norway’s journey to 20% adoption was far from instantaneous, taking roughly 8–9 years, beginning with the introduction of modern EVs in 2011, such as the Nissan Leaf and Tesla Model S.

Norway’s EV Timeline:

- 2011: The EV era began in Norway with mainstream models like the Nissan Leaf. Sales were modest, accounting for less than 1% of new car sales.

- 2014: EV sales reached 5%, marking the first tipping point, driven by tax exemptions, free tolls, and parking perks.

- 2017: EVs crossed the 20% market share threshold, fueled by a broader range of models, improved charging infrastructure, and sustained government support.

In summary, it took Norway 6 years to reach 5% adoption and another 3 years to hit 20%, totaling 8–9 years from the start. Once 20% was achieved, the pace accelerated exponentially, with EVs surpassing 80% market share just five years later.

This timeline underscores how early adoption starts slowly, but once it reaches a critical mass, growth becomes exponential.

Many analysts rely on this localized S-curve adoption model to project global BEV trends. However, I argue that this approach doesn’t fully apply to the global stage.

This isn’t about repeating Norway’s success; it’s about recognizing how global interconnectedness amplifies disruption. The rise of the smartphone provides a compelling analogy: what began as a niche technology exploded into ubiquity once it became global, far outpacing earlier localized adoption trends.

For these reasons, I’m confident that global BEV sales will reach 90-95% by 2030, far exceeding the cautious estimates based on Norway’s S-curve.

This blog complements a previous post I made on the end of the ICE age, highlighting additional factors worth noting.(See: The EV Revolution is Here)

Norway Operated in a Vacuum

Norway’s EV adoption operated in relative isolation. It served as a showcase market, demonstrating the viability of BEVs, but its size wasn’t significant enough to impact global supply chains or oil demand. Norway’s transition was limited to its domestic policy environment and lacked the scale to influence automakers globally.

In contrast, today’s global BEV market is at a completely different stage. With 20% global market penetration now achieved, we are no longer looking at isolated pioneers. This milestone is even more remarkable given that 2024 has been the first year to witness a sharp pullback in demand for legacy automakers, contrasted by strong growth in the EV sector. Instead, the shift is happening across multiple major economies simultaneously, creating a much larger and interconnected demand for BEVs.

The Global Context: 20% = Liftoff

Reaching 20% global BEV sales in 2024 is the tipping point where adoption accelerates exponentially. This isn’t just theory—it’s disruption science. From smartphones to solar, once technologies cross this threshold, growth surges due to:

- Market Familiarity: BEVs are no longer niche; they’re mainstream.

- Price Competitiveness: Falling battery prices (below $50/kWh for LFP) make BEVs more affordable than ICE vehicles across all segments.

- Policy Pressure: Governments worldwide are phasing out ICE vehicles through regulations and incentives.

Unlike Norway, where BEV adoption was driven by policy in a small market, the global tipping point brings economies of scale and supply chain transformation into play. Legacy automakers have struggled to maintain their footing, while the EV sector’s momentum highlights the shift in consumer preferences and manufacturing priorities.

External Catalysts Driving Faster Adoption

1. Supply Chain Maturity

The global BEV market is now backed by massive supply chain investments. Automakers and battery manufacturers are scaling production at an unprecedented rate:

- Tesla, BYD, and Chinese OEMs are leading in battery production and EV technology.

- Global automakers are rapidly retooling factories and securing supply chains for critical minerals like lithium.

2. Oil Demand Disruption

The global oil market is already feeling the impact of BEVs. Unlike Norway, where oil demand wasn’t significantly affected, today’s transition threatens the core of the fossil fuel industry. This disruption creates a feedback loop:

- Reduced oil demand accelerates the shift to renewables and electrification.

- Lower oil profitability pushes automakers further into BEVs.

3. Mandates and Regulation

Countries are no longer just incentivizing BEVs; they are banning ICE vehicles outright. The EU’s 2035 ban is just one example. Developing countries, historically lagging, are also starting to adopt policies to electrify transport.

4. Technological Convergence

The BEV revolution isn’t happening in isolation. It’s part of a broader transition driven by renewable energy, battery storage, and AI. Vehicle-to-grid (V2G) technology will integrate BEVs into decentralized energy systems, creating additional value and accelerating adoption.

5. Imminent ICE Supply Chain Collapse

The ICE supply chain is on the brink of collapse. Declining demand for ICE vehicles has led to factory closures, layoffs, and a reduction in economies of scale for legacy automakers. This drives up the cost of producing ICE vehicles, making them increasingly uncompetitive with BEVs. As manufacturers struggle to maintain profitability, the ripple effect through suppliers and associated industries accelerates the transition to BEVs. The rising costs of ICE vehicles will further incentivize consumers to switch to BEVs, creating a feedback loop that hastens the decline of ICE technology.

Why 90-95% is Achievable by 2030

Using Norway’s adoption curve as a baseline, global adoption will outpace the Norwegian timeline due to the following:

- Simultaneous Scaling Across Major Markets: China, Europe, and the US are driving the transition. China alone accounts for over 50% of global BEV sales, and it’s targeting 100% NEV sales by 2028.

- Global Feedback Loops: Unlike Norway’s isolated market, today’s BEV growth influences supply chains, oil demand, and even geopolitical dynamics.

- Exponential Technology Curve: BEV affordability, range, and charging infrastructure are improving far faster than legacy analysts expected.

Conclusion

The Norwegian EV adoption story is an impressive example of what is possible, but it operated in isolation, driven primarily by local policies. The global BEV transition, by contrast, is being fueled by market forces on an unprecedented scale—forces that didn’t play much of a role in Norway’s journey.

When BEV adoption scales globally, it will disrupt entire industries, reshape geopolitical landscapes, and trigger feedback loops that accelerate growth exponentially. This isn’t just about replacing ICE vehicles but about transforming the foundation of transportation, energy, and industry.

The interplay of collapsing ICE competitiveness, oil market volatility, China’s EV production capacity, and rapid technological advancements is driving an acceleration far beyond traditional S-curve models.

The question isn’t if, but how quickly this disruption will unfold. My bet: faster than anyone predicts.

By 2030, 90-95% of global new car sales will be BEVs. This is not speculation; it’s the logical outcome of forces already in motion.