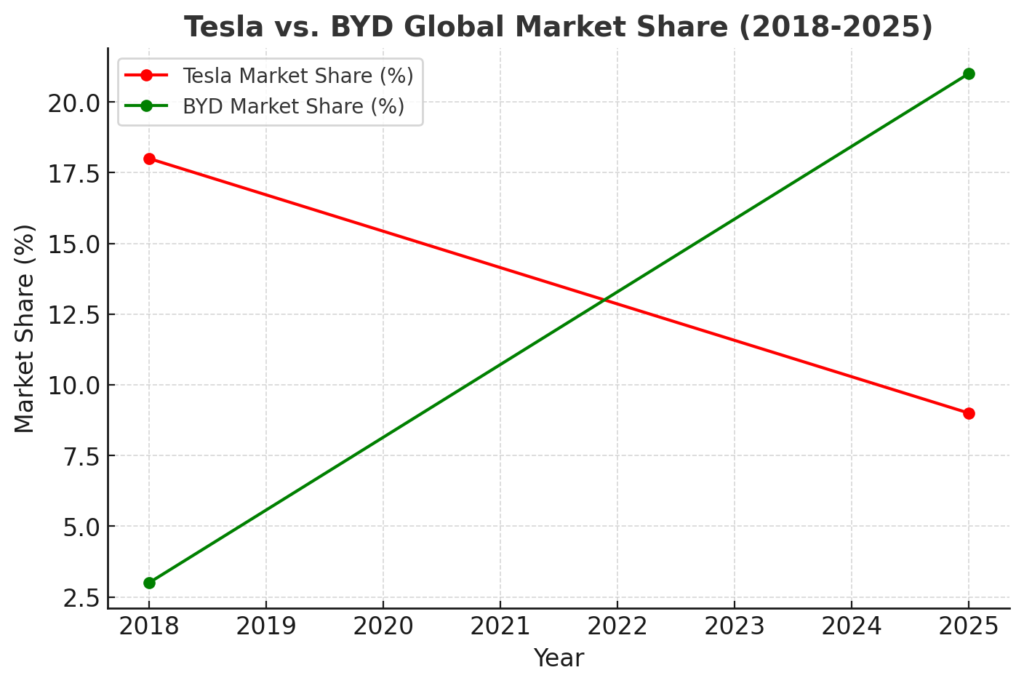

The electric vehicle (EV) industry is undergoing a profound transformation, and Tesla is no longer the dominant force. Once the lightning rod of the EV revolution, Tesla now flickers like a dying bulb—outshined by China’s titans and Europe’s rising automakers. With intensifying competition, macroeconomic shifts, and Elon Musk’s self-inflicted brand damage, Tesla’s role in the industry is shrinking fast. Meanwhile, EV sales are booming, with the first two months of 2025 recording year-over-year record growth—Tesla aside.

Recent reports show Tesla’s sales crashing 72% YoY in Australia, a 49% drop in February in China, and a steep decline across the EU, with Germany down 70% in February, France dropping 26%, and Spain seeing a 44% decline, marking record-low sales across key European markets—highlighting how consumer sentiment is shifting rapidly away from the brand. Lithium demand remains robust, China is taking the lead, and European automakers are proving they can compete. Let’s break it all down.

Tesla’s Brand is Crumbling: A Perfect Storm

From Beacon of Progress to a Toxic Symbol

It takes decades to build a brand, but only months to destroy it. Tesla was once the shining hope of progressives, environmentalists, and tech visionaries—a company that symbolized the clean energy transition. Today, that image is in tatters. Instead of a leader in sustainability, Tesla has become a toxic symbol of corruption, oligarchy, and pro-fossil-fuel regression.

Musk’s personal politics, erratic leadership, and engagement with far-right ideology have driven away core buyers who once championed Tesla as a force for good. The very people who helped propel Tesla to dominance—environmentally conscious, tech-savvy early adopters—are now abandoning the brand in droves.

Musk’s Missteps Alienate Core Buyers

Tesla’s brand, once synonymous with innovation, now battles Musk’s polarizing persona. In Europe, where sustainability values clash with Musk’s rhetoric, Tesla’s sales cratered 45% YoY in January 2025, while the #AnythingButTesla movement trended globally. A 2024 McKinsey study reveals only 45% of Tesla owners would repurchase—down 20 points since 2022. Analysts forecast this number could fall below 40% by Q4 2025, with the EU seeing the biggest declines in January-February 2025, suggesting a wipeout for Q1.

Resale Collapse Undermines Ownership

Used Model 3 values have plummeted 20% since 2023 (Kelley Blue Book), compared to 12% for BMW’s i4. Tesla’s lack of certified pre-owned battery warranties exacerbates consumer anxiety, while BYD offers strong second-hand EV warranties, though details vary by region and model.

Price Cuts Signal Desperation

February 2025’s 5% Model Y price cut in Europe backfired, accelerating defections to Volvo’s EX30 and BYD’s Seal. Analysts warn Tesla risks becoming the “BlackBerry of EVs”—a cautionary tale of squandered dominance.

China’s EV Juggernaut: Innovation at Scale

Tech Supremacy Leaves Tesla in the Dust

- Xpeng’s Solid-State Breakthrough: A 2026 prototype promises 500+ miles of range and 10-minute charging, overshadowing Tesla’s delayed 4680 cells.

- BYD’s Vertical Empire: From lithium mines to LFP batteries, BYD controls its supply chain, slashing costs. The $40K Seal undercuts Tesla’s Model 3 by $15K with superior tech.

Global Ambitions Unchecked

China exported 1.3M EVs in 2024, circumventing tariffs via BYD’s Hungarian factory and SAIC’s Thai plant. Meanwhile, Tesla’s Berlin Gigafactory remains hamstrung by permit delays.

Policy Firepower

Beijing’s estimated $72B EV subsidy pool (2024–2026) dwarfs Western efforts, ensuring Chinese brands dominate affordability and innovation.

BYD’s Rise & The Energy Storage Shift

Tesla’s Powerwall 3 is built with lithium iron phosphate (LFP) cells, sourced from either CATL or BYD. But why pay Tesla’s markup when you can go straight to BYD? With BYD’s battery division improving rapidly and its energy storage solutions expanding, Tesla is losing its grip on the stationary storage market.

BYD’s LFP batteries are cheaper and safer than Tesla’s previous nickel-based alternatives, lasting up to 3,000 cycles versus 1,500. With its Battery-Box now available in over 50 countries, BYD’s direct-to-consumer approach is eroding Tesla’s Powerwall premium. Meanwhile, Tesla has no PR team to counteract growing concerns over its declining brand trust, further worsening its position in the energy sector.

March 2025 Update:

- BYD’s $500M battery factory in Southeast Asia will supply global energy storage projects.

- Tesla’s Powerwall 4 remains missing, causing installers to pivot to BYD’s solutions.

- Solar installers have reported a significant increase in BYD Battery-Box orders since January, though exact figures vary by market.

European EVs Are Getting Competitive

BMW’s i4 vs. Tesla’s Identity Crisis

BMW blends luxury with cutting-edge tech: 300-mile range, ChatGPT-integrated iDrive, and a circular design using 50% recycled materials. Renault’s retro-futuristic Renault 5 E-Tech is dominating the French EV market, proving that nostalgia and affordability can drive mass adoption. Meanwhile, Volvo’s EX30 (€35K) and Volkswagen’s ID.2 (€25K) are setting new benchmarks in the budget-friendly segment—one Tesla never seriously entered, leaving the door wide open.

Regulatory Tailwinds & Market Shifts

Germany’s €5B EV stimulus, the EU’s 2035 ICE ban, and tightening emissions regulations are accelerating Europe’s transition. Tesla, struggling without localized models, sees its market share erode as BMW, Renault, and VW step up with regionally tailored, competitively priced EVs. Legacy automakers are reclaiming ground—but they aren’t the only ones shaking up the market.

China Is Muscling In—Fast

While European brands fight to reposition themselves, Chinese EV makers are crashing the party with a mix of low-cost, high-tech vehicles and strategic market penetration.

🚗 Market Share Surge: Chinese brands (BYD, MG, Nio, Xpeng, Polestar, and Geely’s Lynk & Co) now hold 8-10% of Europe’s EV market, up from just 3% in 2021. Analysts project that share to hit 15-20% by 2025.

🌍 Where They’re Winning:

- Norway & Sweden: BYD and MG are already outselling Tesla’s Model 3 in key months.

- Germany: BYD is positioning itself as a premium brand, while Nio’s battery-swap stations are expanding in Berlin.

- UK & France: MG’s MG4 and BYD Dolphin undercut European rivals on price, outselling the Model 3 in late 2023.

💰 Price Wars & Battery Dominance:

- BYD’s Blade Battery and CATL’s LFP dominance are allowing Chinese automakers to offer EVs that are 20-30% cheaper than their European counterparts—and still profitable.

- Nio and Xpeng are introducing advanced driver-assist features, leapfrogging many legacy brands.

🇪🇺 Pushback Is Coming, But It May Be Too Late

The EU’s anti-subsidy probe into Chinese EVs is expected to lead to tariffs in 2024, but it may only slow—not stop—China’s rise. BYD’s planned European factory in Hungary is a direct play to bypass future tariffs. Meanwhile, legacy brands are scrambling to react with cheaper EVs of their own.

The EV Battlefield Has Shifted

Tesla is collapsing in Europe faster than anywhere else, crushed between legacy automakers reclaiming their turf and China’s aggressive takeover. Musk’s reckless brand destruction couldn’t have come at a worse time—his antics have alienated the very markets Tesla once dominated, leaving the company scrambling as competitors flood in. Meanwhile, Europe’s automakers face a brutal wake-up call: innovate, slash costs, or get steamrolled—just like Detroit when Japan dismantled the U.S. auto industry in the 1970s.

The Bigger Picture – Lithium Demand is Safe

Price Volatility Tests the Industry

Lithium hit $13,000/ton in March 2025 (+8% YoY) amid Chilean strikes, but innovation thrives:

- Cobalt-Free Batteries: BMW adopts LFP tech to comply with the EU’s 2027 Battery Passport.

- Recycling Race: BYD recovers 95% of battery materials vs. Tesla’s 80%, per BloombergNEF.

Geopolitical Gambits Backfire

U.S. tariffs on Chinese EVs leave Americans with fewer options. Result: As of 2023, EVs made up 9.1% of new U.S. car sales, with early 2025 data showing stagnation., while EVs accounted for 53% of new car sales in China during the first two months of 2025.

U.S. Chaos: Policy Whiplash and Missed Chances

Trump’s EV Sabotage

Scrapping tax credits and charging funds forced Ford/GM to pause battery plant expansions, while Tesla’s Supercharger network, which accounts for a large share of U.S. fast chargers, remains a key revenue stream.

Rivian’s Last Hope

The $45K R2 SUV (2026) could revive U.S. EV hopes—if it delivers on its 300-mile range promise.

AI Arms Race Exposes Tesla

Meanwhile, BYD and Zeekr are integrating DeepSeek into their AIs, joining BMW’s ChatGPT-powered iDrive. The promise of Tesla’s Grok AI remains unrealized, further widening the gap in AI-driven automotive innovation. Musk’s robotaxi pivot looks increasingly desperate as Model Y and Highland 3 sales sink.

Tesla’s Full Self-Driving (Level 2) trails Xpeng’s XNGP (Level 3 in Shenzhen). Musk’s robotaxi pivot looks increasingly desperate as Model Y sales sink.

The Final Reckoning: Three Paths to 2030

- BYD Hegemony: Vertical integration secures 40% global EV sales; Tesla becomes a niche AI/robotaxi player.

- European Renaissance: BMW/VW lead premium EVs, shielded by EU tariffs and circular design.

- Wildcard Victory: Xiaomi or Rivian disrupt with tech-infused affordability.

The Bottom Line

Tesla once defined the EV revolution, but the tides have turned. The company now faces mounting competition, brand erosion, and a leadership crisis at a time when the industry is evolving faster than ever. Musk’s unpredictability, price wars, and failure to keep pace with AI-driven vehicle advancements have left Tesla vulnerable. Meanwhile, BYD, Zeekr, Volvo, BMW, and Xpeng are setting the pace—leveraging vertical integration, next-gen battery tech, and AI-powered software to dominate the market. With EV adoption skyrocketing globally and Chinese automakers reshaping the industry, Tesla is at risk of becoming a niche player, surviving on legacy and Supercharger revenues rather than true market leadership.

The EV race is no longer about cars—it’s a battle for control of energy storage, AI, and critical minerals. Tesla, once a pioneer, now faces its “Kodak moment.”

The Road Ahead

The second act of the EV revolution has arrived—a high-stakes drama where cutting-edge innovation collides with geopolitical chess games and the fickle tides of consumer trust. Tesla, once the undisputed protagonist of this story, now faces a labyrinth of challenges. Its early advantages—first-mover dominance, cult-like brand appeal, and vertical integration—are crumbling under the weight of complacency and hyper-competition. To survive, Tesla must shed its skin: a true budget EV could democratize its technology, breakthroughs in AI might reclaim its futurist edge, and doubling down on energy storage could unlock new markets. But the elephant in the room remains Elon Musk himself. Can Tesla reinvent its vision while his polarizing antics alienate customers, spook investors, and invite regulatory firestorms?

Meanwhile, rivals are rewriting the script. BYD, a silent assassin armed with ruthlessly efficient supply chains and rock-bottom pricing, is devouring market share from Stuttgart to São Paulo. Legacy titans like BMW and Volkswagen are weaponizing decades of engineering prowess to dominate the premium EV space, while Chinese disruptors—Xpeng’s autonomous driving feats, Zeekr’s AI-infused user ecosystems—are redefining what a “smart” car means. And as governments turbocharge EV mandates and pour billions into charging grids, the race isn’t just about cars—it’s about controlling the infrastructure of a carbon-neutral future.

Tesla stands at a precipice. Adapt with the precision of a startup, shrink into a niche player, or become a cautionary tale in the annals of corporate hubris. Musk built an empire by dismantling the status quo, but in this new era, the disruptor risks being disrupted. The revolution he ignited now burns brighter than ever—and Tesla must race to avoid being consumed by its own flames.