Electric vehicle (EV) adoption is accelerating across the globe, but much of the narrative has focused on dominant markets like China, Europe, and the United States. However, a silent revolution is underway in emerging economies that were virtual EV deserts just five years ago. This analysis dives into the “Magnificent 7” — seven countries that had negligible EV market shares in 2019 but have since become EV growth champions. This comprehensive review not only examines their market share evolution but also explores the unique economic, political, and industrial forces that propelled their transition from laggards to leaders.

1. Vietnam – From Zero to VinFast Hero

Consumer Trends: VinFast’s identity as a national champion has strongly resonated with Vietnamese consumers. The company’s rapid deployment of charging stations has helped mitigate range anxiety. Early adopters cite patriotism, low running costs, and the convenience of home charging as top purchase drivers.

2019 EV Market Share: ~0%

2024 EV Market Share: Over 22%

Market Share Growth: Exponential (From 0% to 22%)

Vietnam’s EV revolution is tightly linked to the meteoric rise of VinFast. In 2019, EV adoption in Vietnam was virtually nonexistent. There were no domestic EV makers, few imports, and limited awareness among consumers. By 2024, Vietnam has become one of the most promising EV markets in Southeast Asia.

Charging Infrastructure (Global Trend): Across the Magnificent 7, charging infrastructure has rapidly evolved from near-zero availability to dense and growing networks. Governments have leaned heavily on public-private partnerships to build fast-charging corridors, urban charging hubs, and residential access. From Vietnam’s 150,000+ ports installed by VinFast to Turkey’s 8,000 public chargers and India’s goal of 70,000 units by 2030, the pace is staggering. Most countries now mandate charger inclusion in new housing or offer subsidies to install them. This infrastructure backbone has played a crucial role in consumer confidence, enabling EVs to move from niche to mainstream much faster than anticipated. and other energy firms to install thousands of chargers in urban and rural locations. VinFast alone installed over 150,000 charging ports nationwide, including in apartment complexes, malls, and office buildings.

Battery Chemistry & Models: VinFast primarily uses LFP (Lithium Iron Phosphate) batteries, which are known for their thermal stability, safety, and long cycle life, particularly suitable for hot climates like Vietnam. Entry-level models like the VF 5 start around USD $19,000 and deliver up to 300 km range based on the WLTP (Worldwide Harmonised Light Vehicle Test Procedure) standard, which provides a realistic measure of range under mixed driving conditions. in its VF 5 and VF e34 models, offering better safety and longevity in Vietnam’s hot climate. Entry-level models like the VF 5 start around USD $19,000 and deliver up to 300 km range (WLTP), making them highly accessible.

Government Support: Import tax exemptions, green financing, and access to state land for factory expansion played a crucial role in accelerating EV growth.

Vietnam’s transformation underscores how a well-coordinated industrial policy, national branding, and a vertically integrated local player can leapfrog a country into the EV mainstream in just five years.

2. Uruguay – The Per Capita Champion

Consumer Trends: In Uruguay, fleet operators and early adopters have embraced EVs not just for cost savings, but for their alignment with the country’s clean energy identity. Environmental consciousness is a key factor, and EVs are often seen as symbols of social progress.

2019 EV Market Share: ~0.5%

2024 EV Market Share: 15.4%

Market Share Growth: +2980%

Uruguay, a country of just 3.5 million people, has quietly emerged as Latin America’s EV champion on a per capita basis. In 2019, EV adoption was minimal, constrained by high costs and limited availability. By late 2024, BEVs accounted for 15.4% of all new vehicles sold in the country.

Charging Infrastructure: Uruguay invested heavily in nationwide charging networks. The state electricity provider UTE has installed chargers along all major highways and in 100% of department capitals, ensuring countrywide accessibility.

Battery Chemistry & Entry-Level Models: BYD’s Dolphin and Yuan Plus models—both LFP-based—are popular. The Dolphin starts around USD $25,000 with 400 km range (WLTP), while the Yuan Plus offers 450 km. Affordability, low running costs, and ease of maintenance made these popular with fleets and ride-hail operators.

Renewable Integration: With 98% renewable grid electricity, Uruguay’s EVs are nearly zero-carbon from day one. This is a unique advantage in the global EV landscape.

Uruguay’s success proves that small nations with aligned policy, clean energy, and focused execution can leapfrog much larger peers.

3. Thailand – The EV Assembly Line of ASEAN

Consumer Trends: Thai consumers are drawn to EVs as modern, urban-friendly vehicles. The growing middle class appreciates the tech-forward image of EVs, while subsidies have made entry-level models like the Ora Good Cat more accessible. Charging convenience and rising fuel prices also drive adoption.

2019 EV Market Share: ~1%

2024 EV Market Share: 14%

Market Share Growth: +1300%

Thailand is fast becoming the Detroit of Southeast Asia when it comes to EVs. In 2019, EVs were barely a blip on the radar. Fast forward to 2024, and EVs command 14% of the market. The country has attracted tens of billions of dollars in EV manufacturing investment.

Charging Infrastructure: The government launched a national plan targeting 12,000 fast chargers by 2025. Thai oil company PTT and energy provider EGAT have partnered with private operators to deploy ultra-fast charging stations every 100 km along major highways.

Battery Chemistry & Entry-Level EVs: LFP dominates the lower-cost EV segment. GWM Ora Good Cat and BYD Dolphin are popular, both priced around USD $23,000 with 400–450 km WLTP range. GAC Aion and Neta V are also gaining traction.

Industrial Policy: Thailand’s “EV 3.5” subsidy program provides up to $2,800 per EV and import duty waivers, further lowering prices. Local production by BYD and GWM enables pricing competitiveness.

Thailand’s journey shows that with the right mix of incentives, manufacturing capacity, and infrastructure, a country can position itself as a global EV hub in under a decade.

4. Turkey – Domestic Disruption via TOGG

Consumer Trends: TOGG’s strong national branding has stirred pride among Turkish consumers, making it a top choice for those buying their first EV. Tesla’s arrival also created aspirational interest in EVs, prompting tech-savvy urbanites to explore the segment despite economic uncertainty.

2019 EV Market Share: ~0.1%

2024 EV Market Share: 10.1%

Market Share Growth: +9900%

Turkey has made huge strides in EV adoption, hitting 10.1% market share by 2024, up from almost zero in 2019. This success is anchored by TOGG, the country’s first homegrown EV manufacturer.

Charging Infrastructure: The Energy Market Regulatory Authority (EMRA) approved over 50 charging network operators. Turkey now has 8,000+ public chargers with a goal to surpass 20,000 by 2025. Chargers are subsidized in new housing and commercial developments.

Battery & Vehicle Specs: TOGG’s T10X uses LFP chemistry, optimized for safety and durability. The base version offers 314 km WLTP range and costs around USD $42,000. Tesla and Renault are also offering models in Turkey, expanding choices.

Government Strategy: Significant tax breaks, direct subsidies, and land allocation for TOGG’s factory show strong state support. EV charging firms also receive R&D and deployment incentives.

Turkey’s rapid catch-up illustrates how domestic industrialization and government coordination can create national champions that reshape the automotive landscape.

5. Brazil – Volume in the Making

Consumer Trends: Brazilian consumers are increasingly choosing EVs for lower operating costs and the prestige associated with owning a modern vehicle. Environmental factors are secondary to economic ones. Access to cheaper models like the Dolphin Mini has widened appeal beyond urban elites.

2019 EV Market Share: ~0.2%

2024 EV Market Share: ~7%

Market Share Growth: +3400%

Brazil’s 7% EV market share in 2024 marks a turning point. While hybrids still make up a large portion, BEVs are catching up fast. BYD now leads Brazil’s EV sales, even ahead of local legacy brands.

Charging Infrastructure: Brazil’s energy agency ANEEL approved public-private partnerships for corridor charging. São Paulo, Rio, and Brasília have urban fast-charging hubs. BYD and Volvo are co-investing in 1,000+ fast chargers by 2025.

EV Specs & Pricing: The BYD Dolphin Mini launched at just USD $21,000, offering 300 km WLTP range using LFP batteries. The Yuan Plus and Seal U serve higher-end buyers. Most EVs sold are under $35,000.

Manufacturing Expansion: BYD’s new factory in Camacari is set to begin production in 2025 with a 150,000-unit annual capacity. Localized production will further reduce costs.

Brazil is no longer on the sidelines. It is becoming the largest EV market in Latin America by volume and an important center for future battery and vehicle production.

6. India – Two-Wheelers First, Four-Wheelers Next

Consumer Trends: In India, cost is king. Two-wheelers dominate EV adoption due to their affordability and maneuverability in congested cities. Consumers are warming up to four-wheelers like the Tiago EV, but concerns over range, resale value, and charging access persist in non-metro regions.

2019 EV Market Share: ~0.1%

2024 EV Market Share: 7.7%

Market Share Growth: +7600%

India’s EV market is unlike any other, with most adoption concentrated in two- and three-wheelers. Still, passenger EVs are surging.

Charging Network Growth: India had just 650 public chargers in 2019. By 2024, there are over 12,000 operational units, and the Ministry of Power is targeting 70,000 chargers by 2030. Tata Power, Ather Energy, and Statiq are major players.

Battery Chemistry: Tata Motors and MG offer LFP-based vehicles in the low-cost segment. The Tiago EV, starting at ~USD $11,000, delivers 250 km range. Nexon EV offers 320–460 km range depending on the variant.

Incentives: Central and state subsidies under FAME-II reduce EV prices by 10–20%. Road tax exemptions and free registration help, especially in Maharashtra, Delhi, and Gujarat.

India’s shift is driven by urban air quality, oil import costs, and growing confidence in domestic battery production. The ecosystem is now self-sustaining and rapidly maturing.

7. Indonesia – The Sleeping Giant Wakes

Consumer Trends: Indonesian consumers are still early in the EV curve but show increasing interest, especially in compact, affordable models like the Air EV. Government incentives and rising fuel prices are nudging demand, but long-term success depends on improving charging access and public trust in EV durability.

2019 EV Market Share: ~0.08%

2024 EV Market Share: ~5%

Market Share Growth: +6150%

Indonesia is one of the world’s most promising EV markets due to its resource endowment and market size.

Charging Infrastructure: In 2019, chargers were scarce. By 2024, Pertamina, PLN, and Hyundai have installed hundreds of charging stations. Indonesia plans to deploy 6,000 public chargers by 2026, focusing on urban centers and tourism corridors like Bali.

Battery Tech & EV Models: Hyundai’s Ioniq 5 and Wuling’s Air EV use LFP and are manufactured locally. The Air EV is priced at ~USD $17,000 and offers 300 km range—perfect for city use. Neta V and Seres E1 are new low-cost entries.

Government Policy: Import tax waivers, VAT cuts (from 11% to 1%), and production-linked incentives have made EVs more affordable. The country is also leveraging its vast nickel reserves to attract battery manufacturing.

Indonesia is no longer asleep. It’s assembling its own supply chain, from mine to motor, and the results are already showing in sales and investment trends.

Final Thoughts: What the Magnificent 7 Teach Us

These seven countries are not just emerging EV markets—they are proving grounds for how policy, local industry, and foreign investment can converge to accelerate technological change. Each story is different, but common threads include:

- Strategic investment in charging infrastructure, often via public-private partnerships

- LFP battery chemistry dominating entry-level and mid-range segments

- Sub-$25,000 EVs providing up to 300–450 km WLTP range, making them highly practical

- Strong policy direction through subsidies, tax incentives, and manufacturing support

The EV transition is no longer a first-world phenomenon. It’s global. And these Magnificent 7 are living proof that even nations starting from near-zero can become leaders within a decade if the will and strategy align.

Looking ahead, the question is whether these nations can sustain momentum amid intensifying global competition, rising battery material costs, and evolving consumer demands. Will countries overly reliant on one domestic automaker remain resilient? Will emerging supply chains be green and equitable? And might these rising markets ultimately offer models that developed nations will one day emulate?

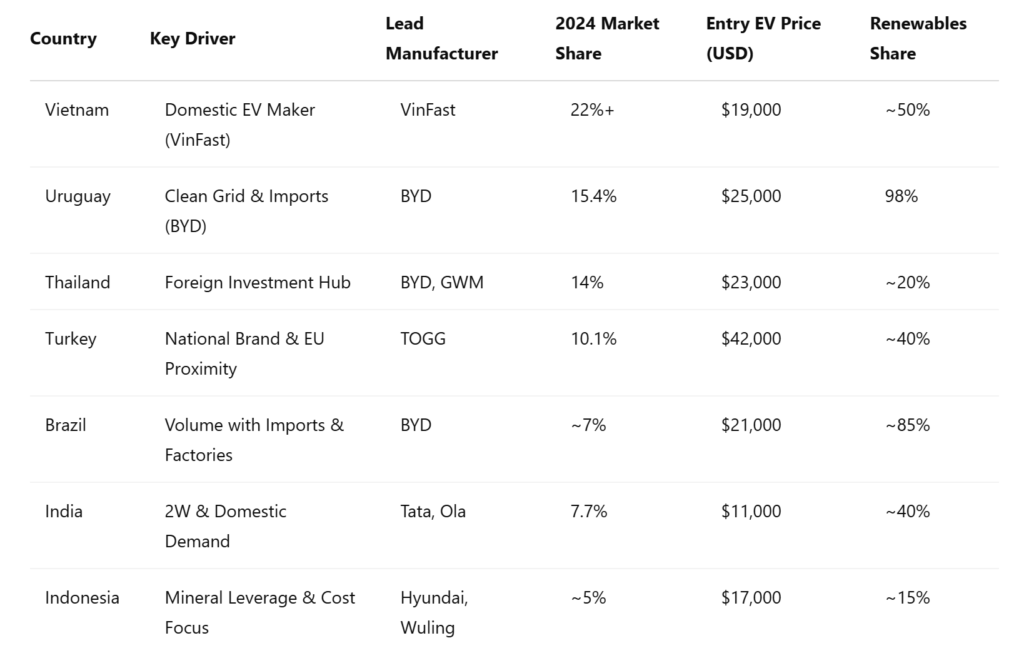

To better understand their unique positions, here’s a quick comparative snapshot:

Each market shows that there’s no single path to EV adoption. From Uruguay’s clean energy advantage to Vietnam’s VinFast-driven surge and India’s price-sensitive two-wheeler revolution, success takes different forms.

What’s Next?

The rapid acceleration of EV adoption in these countries opens up new strategic questions about scalability, resilience, and economic impact:

- If battery material prices increase by 20%, Indonesia could benefit due to its nickel reserves, while import-reliant Brazil may face headwinds — albeit with the global shift away from NCM chemistry and toward LFP, this impact could be somewhat mitigated.

- Will China’s low-cost exports spark new price wars in these emerging regions?

- Could India become the dominant exporter of low-cost EVs in the Global South?

What Do You Think?

Which of the Magnificent 7 will lead EV adoption by 2030—and why? Let us know in the comments!