Donald Trump’s return to tariff politics isn’t just about trade—it’s about ideology. By shielding America’s declining fossil fuel industry and blocking access to cheaper, cleaner technology, his administration is attempting to rewind the clock on the energy transition. But in doing so, it’s not slowing the transition—it’s speeding it up everywhere else. The International Energy Agency (IEA) projects global fossil fuel demand will peak by 2030, yet U.S. tariffs on clean tech imports have surged—now reaching up to 145% on Chinese goods, with a universal 10% baseline tariff and 25% on steel and automobiles. This dissonance underscores a central irony: efforts to delay the transition are catalyzing it. By distorting energy markets, tariffs and subsidies are inadvertently creating a global ‘clean tech arms race’—one the U.S. is losing. Meanwhile, Trump’s 10% tariff on Canadian oil raised prices in U.S. states like Michigan and Minnesota. And in states like Ohio, fossil fuel industry-backed campaigns passed laws reclassifying natural gas as “clean energy”—securing subsidies that undermine clean tech.

This article serves as a companion to my earlier blog, Trump’s Tariff Trap: How EVs Could Win the Auto Wars (March 2025), which explored how protectionism could unintentionally accelerate electric vehicle adoption. That piece focused on the auto sector—how tariffs might corner legacy automakers into faster electrification. This blog expands that thesis to a macro level, examining how the same dynamics are playing out across energy markets, infrastructure, and global supply chains.

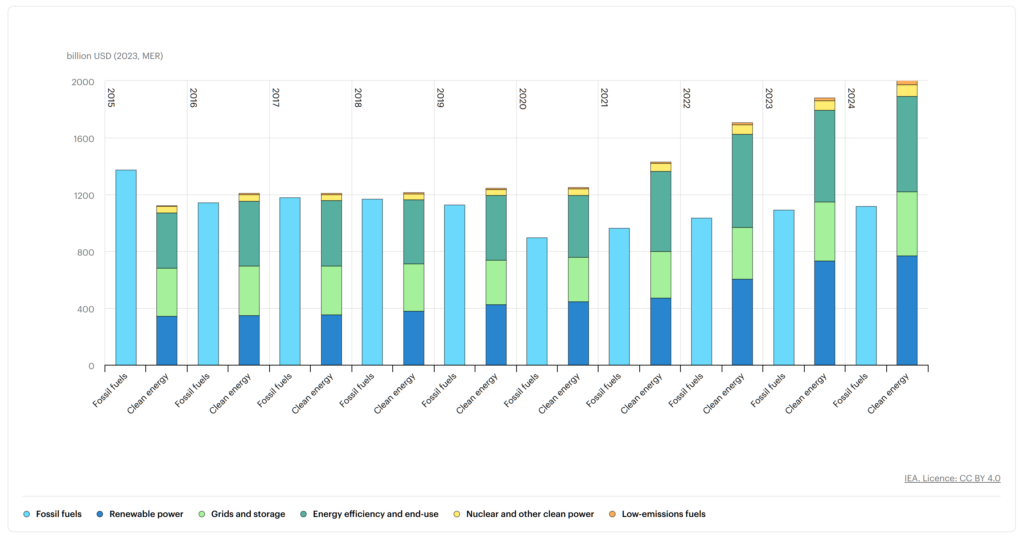

The Free Market Irony Trump’s tariffs—a 10% universal baseline, 145% on Chinese goods, and 25% on steel and automobiles—disrupted clean energy supply chains, raising U.S. solar costs 18% and battery prices 25%, while EU prices fell 22% (IEA, 2024). With China making 75% of lithium-ion batteries, India and Indonesia boosted their own factories. In 2024, clean energy investments hit $2 trillion, doubling fossil fuels (see chart). Steel tariffs hiked wind turbine costs 12%, pinching both renewables and fossil drilling. The U.S. Chamber of Commerce warns families face a $3,500 yearly hit, especially lower-income households. Protectionism props up old industries but slows progress.

Russia’s Mistake: A Case Study Russia’s energy weaponization backfired. EU renewables now meet 50% of electricity demand. In response to volatile fossil fuel markets, several emerging economies began pivoting away from LNG imports. Pakistan, for example, rolled out 17 GW of solar in 2024—one of the largest programs outside the West—significantly reducing its LNG reliance. Other countries in Asia and Africa are now following suit, leveraging low-cost solar as a hedge against fossil price shocks. Russia’s oil revenues dropped 40% by 2024. U.S. LNG exports to Europe fell 15% as countries shifted toward wind and solar. Meanwhile, the U.S. is doubling LNG export capacity—just as demand weakens globally. Like Russia, the U.S. risks miscalculating the future of energy.

The Baltic States: A Blueprint for Energy Independence Lithuania’s shift from Russia’s grid to offshore wind by 2025 shows how necessity drives renewables. Estonia and Latvia echo this model with wind expansion and EU grid integration. Estonia slashed oil shale use by 90% since 2022 and joined a €500B EU offshore wind grid project. Regional collaboration outpaced energy nationalism.

U.S. Replays Old Mistakes Trump’s 2025 tariff plan risks inflating costs and cutting 35,000 solar jobs, while Biden’s IRA (a clean energy subsidy program) generated 200,000 EV jobs. Brazil and India sidestepped U.S. pressure with pro-China and pro-domestic EV policies. U.S. solar developers scrambled to stockpile panels—a short-term fix exposing long-term fragility. The U.S. is repeating the energy policy missteps others have moved beyond.

Winners & Losers: The Shift Accelerates

- Winners:

- China: Controls 75% of global battery supply chains.

- EU: Cut emissions 40% since 2005 through regional integration.

- Mexico: Leveraged USMCA (a North American trade deal) to become an EV manufacturing hub.

- Nigeria: 2024 mini-grids powered 2 million homes, bypassing diesel and LNG.

- Gulf States: Saudi Arabia’s $10B solar plan targets 50 GW by 2030, powering 5 million homes, while UAE secures lithium supply deals (key for EV batteries).

- Losers:

- U.S. LNG exporters & fossil fuel lobbying: Oversupply meets weakening demand while $5.9T in inefficient subsidies persist.

Conclusion: You Can’t Tariff the Sun This tariff war isn’t just old vs new superpowers—it’s old energy vs new. The West clings to fossil-fueled legacy industries with tariffs and tantrums, while China powers ahead with EVs, batteries, and solar. This isn’t just trade friction—it’s the birth pangs of a new energy era.

Renewables now beat 77% of coal plants on cost (UN/IEA). To remain globally competitive, the U.S. must urgently course-correct: exempt Chilean lithium (a battery mineral), ramp up investment in energy storage, share grid tech (smart energy systems) with forward-leaning partners like Estonia, and abandon plans to overbuild LNG export capacity.

The trajectory Trump is setting leads down a path of rising energy costs, stranded infrastructure, and delayed innovation. This is how the sunk cost fallacy plays out in real time: doubling down on obsolete industries even as global markets move on. It’s not just bad policy—it’s a strategic miscalculation that risks ceding the future of energy to others.

Protectionism may offer short-term cover for fossil incumbents, but it sabotages the long-term resilience and leadership potential of America’s clean energy economy. Ironically, the very tariffs and fossil-centric trajectory the U.S. is doubling down on will accelerate the global clean tech transition elsewhere. Other countries—prioritizing stability, affordability, and energy independence—will increasingly pivot toward renewables to escape the price shocks, supply risks, and geopolitical entanglements of fossil fuels that the U.S. still sees as a profit center. The world will move on. Faster.