Coal was the crucible of empire—black stone turned kinetic force. It summoned steam from silence, turned gears of industry, and pulled steel arteries across continents. From the belching stacks of Birmingham to the blast furnaces of Wuhan, coal was the dense, combustible promise of progress. It compressed millennia of sunlight into a century of velocity—fueling the Industrial Revolution, electrification, mass production, and mechanized war.

But its gifts were never given freely. Coal extracted more than energy—it mined lungs, hollowed towns, and scorched the biosphere. It released not just power, but particulates, sulfur, and CO₂—billions of tonnes of carbon laid as tribute at the altar of short-term growth. It was entropy masked as order.

Now, the physics has shifted. Solar and wind are cheaper per kilowatt-hour in most regions, storage is scaling, and coal’s thermal inefficiency—wasting up to two-thirds of its energy as heat—can no longer compete with photons and electrons dancing at near-zero marginal cost. The capacity factors once claimed as coal’s strength have crumbled under the flexibility of distributed renewables.

The coal age is not winding down—it is combusting into history. What remains are the ashes of empire: stranded assets, shuttered plants, and supply chains built for a past that no longer scales. In a changing world, coal’s final flame flickers—not with a bang, but with the quiet inevitability of obsolescence.

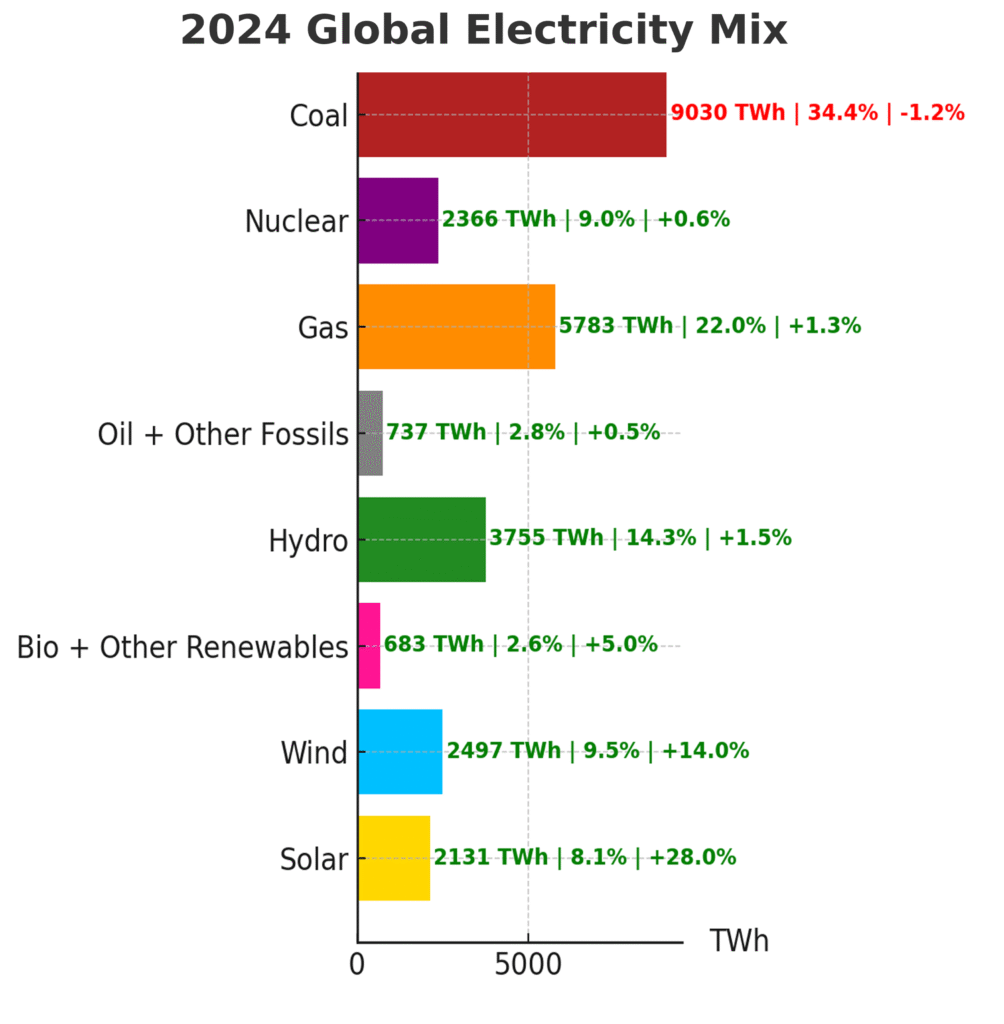

⚡ By the Numbers: Coal’s 2024 Snapshot

- 8.77 billion tonnes burned 🔥 (record high)

- 34.4% of global electricity share ⚡

- –1.2% YoY growth 📉

1. Global Use and Trends

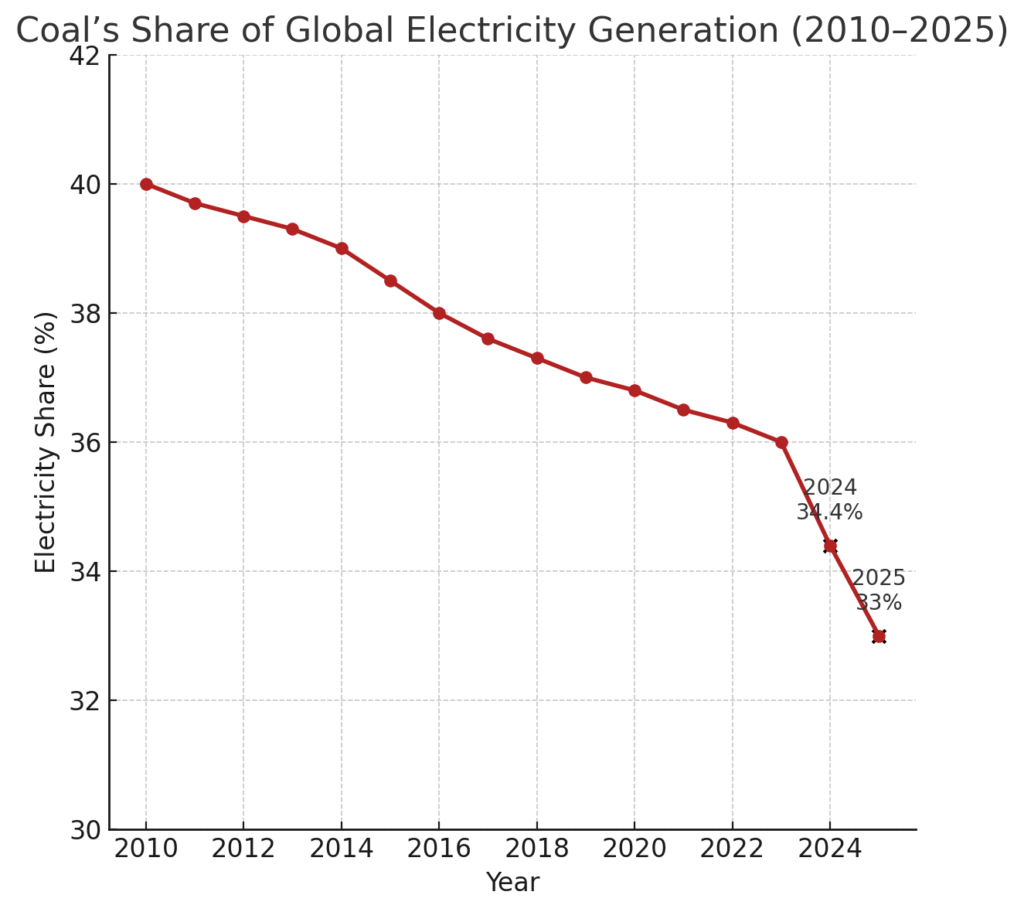

Coal still plays a significant role in the global energy mix, accounting for about 34.4% of global electricity generation in 2024, projected to decline to below 33% in 2025, according to the International Energy Agency (IEA). Consumption hit a record 8.77 billion tonnes in 2024, driven primarily by China and India. While this marked the highest volume of coal burned globally, coal’s share of total electricity generation actually declined—reflecting the broader surge in global electricity demand and the rapid scaling of renewable energy. China alone made up 56% of global coal use, while India saw the fastest growth.

In contrast, coal use in the U.S. and the EU is plummeting. EU coal consumption fell by 23% in 2023, and the U.S. posted similar double-digit declines. These regions are actively retiring coal plants, replacing them with renewables and gas. However, this trajectory in the U.S. has already shifted under Trump’s second term. His administration is aggressively attempting to resurrect coal’s role in the energy mix—rolling back climate regulations, pushing subsidies for fossil fuels, and pressuring agencies to keep uneconomical coal plants running. It’s a nostalgic revival effort rooted in the past, but despite these moves, market forces continue to erode coal’s viability. Policy can delay the inevitable—but it can’t reverse the tide. Despite billions in subsidies, U.S. coal jobs continue to vanish—while renewables now employ over 10 times as many people.

2. Short-Term Drivers

The recent bump in coal demand isn’t a resurgence—it’s a response to specific pressures:

- Droughts in China sharply cut hydro output, increasing reliance on coal.

- Post-COVID industrial rebound in Asia spiked energy needs.

- Energy security concerns, especially after Europe’s 2022 gas crisis, pushed countries to secure baseload power.

- Sunk costs in relatively new coal infrastructure across Asia keep plants operating despite cheaper alternatives.

But these are temporary. As hydropower stabilizes and renewable buildouts accelerate, the dependence on coal will weaken.

3. Structural Decline Is Imminent

While coal demand rose in 2023, all indicators suggest it’s about to peak:

- Unofficial estimates suggest over 80% of proposed new coal power projects in China were denied approval in 2024, reflecting a strong policy pivot away from coal. Further validation from official NEA or provincial energy bureau sources would solidify this figure.

- The IEA confirms that global coal demand peaked in 2023 and began declining in 2024, falling by approximately 1.2%. A further 0.6% drop is projected for 2025, reinforcing that this is not a temporary dip but the start of a sustained shift. This marks the beginning of a structural decline—not a temporary contraction—with a clear downward trend already underway.

- Solar and wind are now cheaper than coal in most regions, including China and India. According to BloombergNEF and IRENA, the levelized cost of electricity (LCOE) from solar PV and onshore wind fell below that of coal in over two-thirds of the world by 2023—and this trend only deepened in 2024, as solar and wind costs continued to decline while coal prices remained volatile. In China, utility-scale solar is now routinely auctioned at prices 30–40% lower than coal-fired electricity, and in India, solar bids have reached record lows of ₹2.14/kWh (≈$0.026)—well below the average coal generation cost. This economic advantage is accelerating coal’s displacement across emerging markets.

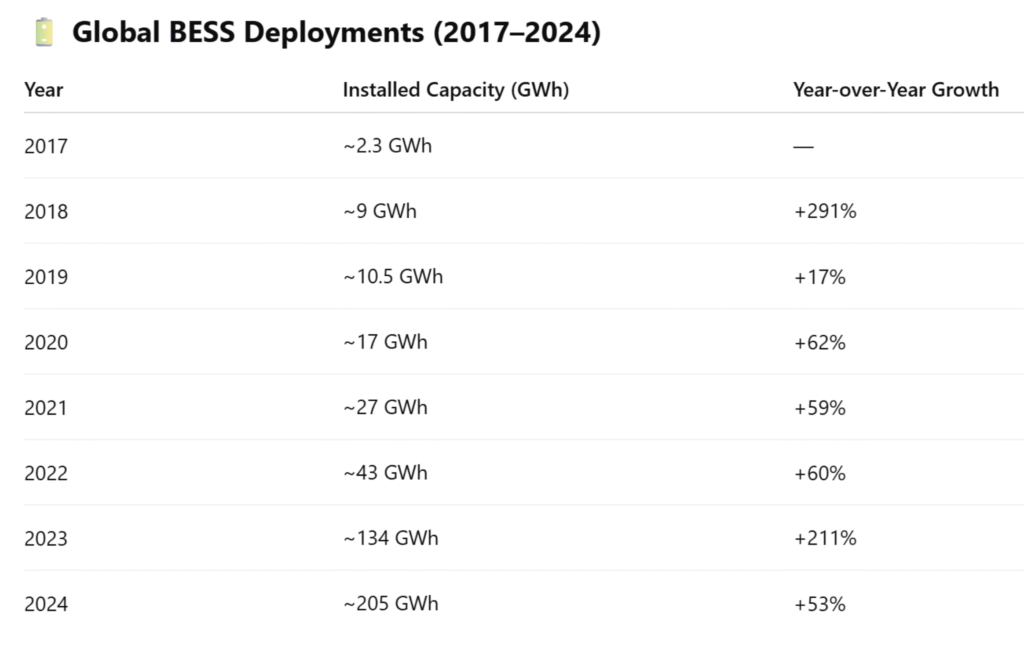

- Battery storage (BESS) capacity is growing rapidly (130% growth in 2023), solving the intermittency problem that once favored coal.

Coal isn’t being outcompeted only on emissions—it’s being outcompeted on every axis that matters: cost, speed of deployment, operational flexibility, scalability, and long-term resilience. Wind and solar can now be built faster and cheaper than coal, even in the Global South. Modern grids with battery storage can better match demand fluctuations than inflexible coal baseload power. The once-perceived reliability of coal is no longer competitive when storage, demand response, and distributed energy systems come into play.

One quick look at a chart of coal’s electricity share tells the story: 2010–2025 → 40% → 33%. This is not just a decline—it’s a phase shift.

4. Financial and Market Headwinds

- Over 160 major banks now restrict coal financing.

- Major insurers (e.g., Allianz, Swiss Re) are exiting coal.

- ESG funds and institutional investors are dumping coal assets to avoid stranded asset risk.

- Example: In 2023, HSBC announced a complete phase-out of coal financing by 2040 globally, and by 2030 in OECD countries.

Coal has become a toxic asset class, increasingly incompatible with long-term financial risk models.

5. Health and Climate Toll

Coal is the largest single source of energy-related CO₂ emissions, responsible for over 40% globally. It’s also a major contributor to deadly air pollution:

- Linked to 4 million+ premature deaths annually (Harvard)—that’s one death every 8 seconds.

- Causes acid mine drainage and contaminates ecosystems.

- Example: The closure of the Hazelwood coal plant in Australia in 2017 led to a measurable drop in local air pollution and respiratory hospital admissions.

It is an environmental and public health crisis masquerading as an energy solution.

6. Geopolitical Shifts

- The EU’s Carbon Border Adjustment Mechanism (CBAM) will penalize coal-heavy exporters. For example, coal-intensive steel and cement from countries like India and China will face increasing costs when entering EU markets.

- In 2015, China’s Belt and Road Initiative (BRI) funded over 40 coal plants abroad. By 2023, 60% of its energy financing had pivoted to renewables—a wholesale strategic shift. Case in point: new solar infrastructure projects in Pakistan and wind projects in Central Asia.

- Countries clinging to coal face reputational and economic consequences as clean energy becomes a global norm.

7. Verdict: Coal’s Last Gasp

“Markets are voting with their wallets—and coal lost.” — Carbon Tracker analyst

The myth of coal’s comeback is a dangerous illusion. Temporary demand spikes—often driven by droughts, cold snaps, or post-COVID rebounds—are mistaken for revival. Nowhere is this misreading more common than in China, where rising absolute coal use masks a profound structural shift. While the headlines scream “coal boom,” the real story is happening in the background: exponential growth in solar, wind, and battery storage, coupled with ruthless efficiency gains and decarbonization mandates.

This is the China paradox—often misunderstood in the West. Analysts fixate on raw tonnage while ignoring the trendlines. Coal’s share in China’s energy mix is collapsing even as absolute volumes rise—because total electricity demand is surging and renewables are scaling faster than any nation in history. What looks like resurgence is actually momentum toward obsolescence.

Coal isn’t exiting with drama, but with diminishing relevance. A fossil relic in slow retreat, it’s being priced out, legislated out, and innovated out of existence. Its emissions are no longer the price of progress—they’re the cost of delay. Every coal-fired megawatt today is a monument to yesterday’s thinking.

The age of centralized, carbon-heavy power is crumbling under its own inefficiency. In its place rises a new energy architecture—cleaner, faster, cheaper, and decentralized. The next energy crisis won’t be about shortages of supply, but surpluses of denial. The winners will be those who adapt—not those who cling to soot and sentiment.

Coal was the engine of empire. Now, only ashes remain.

The sun is rising. Coal is setting.

References

- Ember. (2025). Global Electricity Review 2025.

https://ember-climate.org/insights/research/global-electricity-review-2025 - International Energy Agency (IEA). (2024). Electricity Market Report – June 2024.

https://www.iea.org/reports/electricity-market-report-june-2024 - Energy Storage News. (2025). Global BESS Deployments Soared 53% in 2024.

https://www.energy-storage.news/global-bess-deployments-soared-53-in-2024 - Rho Motion. (2025). Battery Storage Capacity Trends – 2024 Summary.

https://rhomotion.com/news/global-bess-deployments-surpass-expectations-in-2024 - Harvard T.H. Chan School of Public Health. (2020). Fossil Fuel Air Pollution Responsible for 1 in 5 Deaths Worldwide.

https://www.hsph.harvard.edu/news/press-releases/fossil-fuel-pollution-causes-one-in-five-deaths-worldwide - Carbon Tracker Initiative. (2024). Banking on Climate Chaos – Financial Institutions and Coal Exit Strategies.

https://carbontracker.org - Global Energy Monitor. (2024). Global Coal Plant Tracker – January 2024 Edition.

https://globalenergymonitor.org/projects/global-coal-plant-tracker