🔍 30-Second Takeaway:

- BEVs will hit 90% of global car sales by 2030 (down from 95% due to U.S. policy shifts)

- China leads (100%), Europe follows (70%+), U.S. lags (50%)

- 3 key drivers: Battery cost plunge, ICE supply chains collapse, renewable energy synergy

- Biggest risk: Charging infrastructure gaps in emerging markets

What if I told you that even with political setbacks, EVs will dominate car sales by 2030? That’s right—despite recent challenges, the road to mass BEV adoption is still clear. Back in December 2024, I projected that global BEV (Battery Electric Vehicle) sales would reach between 90-95% of total vehicle sales by 2030. This forecast was based on several critical factors: technological improvements, cost reductions, increasing consumer acceptance, and strong policy support from major economies.

However, as we move into 2025, new developments have prompted a reassessment of these projections. While my 2024 forecast was accurate—missing the actual NEV (New Energy Vehicle) final sales figure by just 100,000 units—I have now factored in the ‘Trump effect’ when updating my 2025-2030 outlook.

The ‘Trump Effect’: Why It Matters

The ‘Trump effect’—including a 25% tariff on imported EV batteries, reduced federal tax credits, and emissions regulation rollbacks—could raise U.S. EV prices by 10% and slow sales growth by 5%. As the U.S. remains a major automotive market, this impacts global adoption, lowering my projection from 95% to 90% by 2030. However, state initiatives like California’s zero-emission mandates and New York’s infrastructure investments may mitigate these setbacks. Local policies can counteract federal headwinds, keeping the BEV transition on track.

Despite the potential challenges posed by the ‘Trump effect’, strong consumer demand, rapid battery innovation, and international momentum for EV adoption persist. Europe and Asia are doubling down on their commitments to electric mobility, driven by emissions regulations and aggressive electrification targets.

Why the BEV Revolution Is Still on Track

Technological advancements continue to lower the cost of ownership, with new battery technologies like LFP and sodium-ion promising even greater affordability and efficiency. Recent insights from ARK Invest suggest that EV adoption is surpassing traditional S-curve dynamics, indicating a more rapid and expansive growth trajectory. As battery costs decline, EVs become accessible to new consumer segments, sparking fresh waves of adoption. ARK’s analysis highlights that, rather than plateauing, EV adoption is accelerating, driven by overlapping adoption cycles as cost reductions make BEVs increasingly attractive to budget-conscious buyers. According to BloombergNEF, battery costs have fallen from $132/kWh in 2022 to $89/kWh today, with LFP batteries already at $50/kWh in China. Coupled with 500KW global fast chargers expected by 2025 (IEA), the cost and convenience of BEVs are set to dominate new car sales.

Emerging markets like Latin America, India, and Africa face challenges with charging infrastructure, but affordable EVs from brands like BYD and sodium-ion battery tech offer potential solutions. A major driving force here is the desire of everyday people to break free from oil dependency and escape the cycle of petrol price gouging. The economic motivation for energy independence is especially strong in developing regions, where fuel costs can take a significant portion of household income. By transitioning to cheap renewables and EVs, these communities can reduce reliance on volatile oil, coal and gas markets, making electric mobility not just a technological shift but a social and economic liberation. These regions, with their growing demand and focus on cost-effective solutions, could have an edge in reaching 90% adoption by 2030 if infrastructure gaps are addressed.

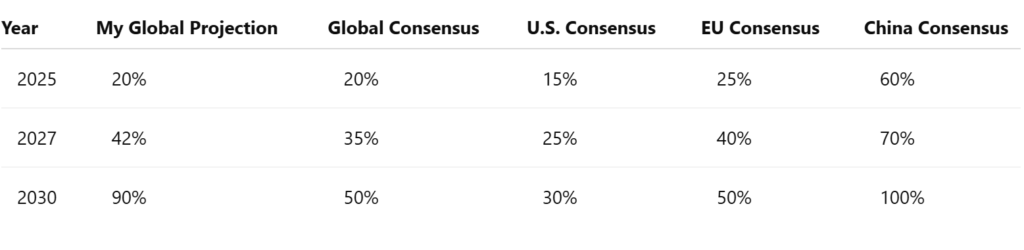

My Projections vs. Consensus

While the consensus often lands around 50% BEV sales by 2030, I project 90% based on the S-curve formula used to model adoption in Norway, Denmark, and Sweden. Key factors include battery cost reductions, technological advancements, and the collapse of ICE supply chains. I also foresee that from 2027 onwards, global PHEV sales will begin collapsing. PHEVs have long been viewed as a transitional technology—providing a safety net for those wary of limited range or charging availability. However, advancements in battery density, particularly with LFP and sodium-ion technologies, are rapidly making PHEVs obsolete. As costs drop and range extends, the onboard petrol generator loses its appeal, especially when BEVs offer lower maintenance, running costs, and a simpler powertrain.

From 2027 to 2030, the growth of BEVs will be exceptionally strong for several reasons. First, the maturity of next-gen battery technologies will push prices well below parity with ICE vehicles, making BEVs the obvious financial choice. Second, legacy automakers, facing increasing pressure to electrify, will accelerate their BEV lineups while phasing out hybrids. Lastly, consumer preferences will continue to shift toward pure electric as charging networks expand and EV infrastructure becomes more ubiquitous, reinforcing the idea that hybrids were merely a temporary stepping stone. I wrote more in depth on this subject in Why PHEVs Are Losing Their Shine.

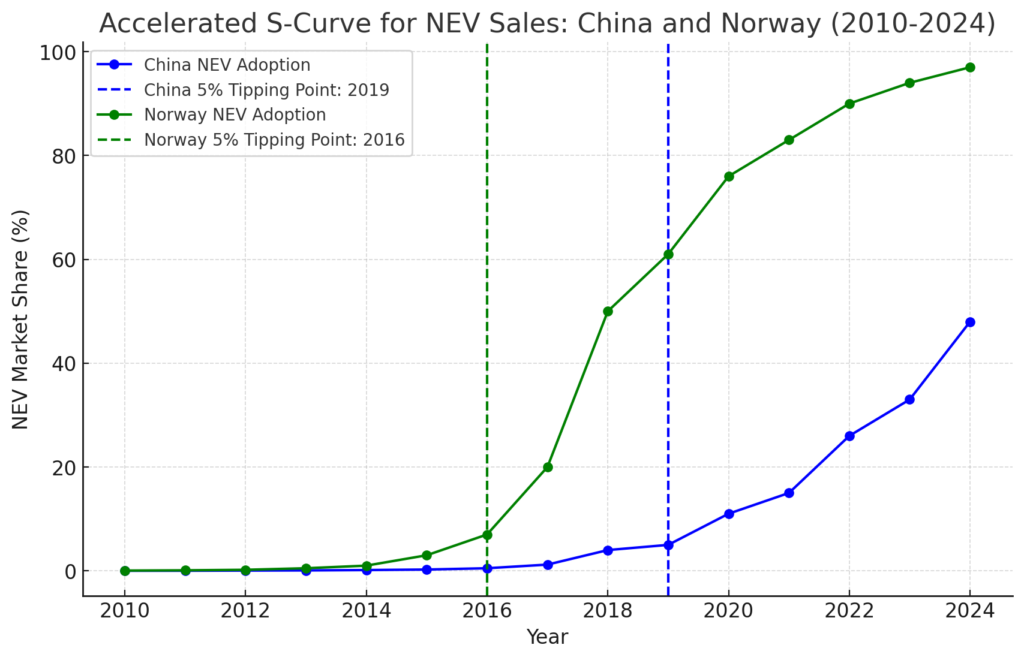

S-Curve vs. Linear Growth: Visual Comparison

The graph illustrates how the adoption rate accelerates significantly past the 5% tipping point, following patterns seen in Norway and China. In contrast, linear growth models underestimate the speed of transition.

Risks and Wildcards

Upside: Breakthroughs in solid-state batteries, oil price spikes, autonomous ride-hailing adoption.

Downside: Lithium shortages, legacy automaker bankruptcies, regulatory uncertainty, geopolitical tensions.

Conclusion

Despite policy challenges, based on my figures, Global BEV adoption is set to reach 90% by 2030. Falling battery costs, renewable energy integration, and consumer demand are pushing the transition. Automaker adaptation and charging infrastructure expansion will be critical for maintaining momentum.

Reaching 90% BEV sales by 2030 will seem very ambitious to many, but the convergence of economic, technological, and social factors makes this target increasingly plausible. While policy shifts and market dynamics will continue to shape the landscape, the trajectory toward a predominantly electric future appears robust and well underway.