Tesla wasn’t just another car company—it was a revolution. A pure disruptor. It flipped the script on an industry that had become stagnant, bloated, and addicted to oil. With no legacy baggage, no dealer networks, and a software-first mindset, Tesla reinvented what a car could be.

It gave us over-the-air updates, blistering EV performance, stunning design, and vertical integration that made legacy OEMs look like dinosaurs shuffling through tar.

But something’s shifted.

Over the past two years, the energy that once defined Tesla—the aggressive, future-forward innovation—has dulled. Instead of the relentless push toward radical new frontiers, we’re watching a company focus increasingly on margin protection and profitability. In other words, Tesla is starting to act… like the legacy automakers it once set out to destroy.

The signs are everywhere:

- The $25k EV, long promised, is nowhere in sight.

- Cybertruck delays and scaling problems abound.

- Robotaxi is perpetually “next year.”

- FSD remains a beta product despite customers paying thousands since 2017.

Even Elon now admits Tesla customers have effectively funded FSD development by prepaying for a feature that still doesn’t exist in a finalized, approved form. That’s not disruption. That’s rent-seeking.

Meanwhile, the competition is heating up—from below. Chinese EV makers like BYD, Xiaomi, Zeekr, and Xpeng are hungry, fearless, and moving with brutal speed. They’re launching high-quality, fully featured vehicles at half the cost—today—equipped with their own FSD systems using LiDAR and advanced sensors, plus charging networks that are up to three times faster than Tesla’s once-gold-standard Supercharger network.

While Tesla cuts prices to defend market share, it’s no longer innovating fast enough to leap ahead. Instead, it’s stuck defending ground it’s already won.

To be fair, Tesla hasn’t abandoned all innovation. Projects like Dojo, Optimus, and its expanding energy storage division show sparks of its original ambition. But those efforts remain early-stage or symbolic compared to the urgent challenge at hand: maintaining leadership in a hyper-competitive EV space. In 2023, Tesla’s global EV market share slid from 19% to 17%, and in China—its most critical market—it’s being outpaced by BYD, who now sells EVs at nearly half the cost. Even Tesla’s once-market-leading R&D spend, at around 4% of revenue, now lags behind tech-driven rivals.

The Sales Slide

Tesla’s sales are falling—and fast. In China, its once-commanding position is being eroded month after month. According to recent data, Tesla’s NEV market share in China fell to just 6.9% in May 2025, down from 10.5% a year prior. It sold approximately 37,500 vehicles in China that month—a 25% year-over-year decline.

Globally, it’s a similar story. Tesla delivered around 1.29 million vehicles in H1 2025, down from 1.38 million in H1 2024, marking a 6.5% YoY drop—its first H1 decline in over five years.

The financials echo the decline. In Q1 2025, Tesla’s net income dropped 42% YoY, and operating margins shrank to 7.2%—the lowest since 2017. Price cuts aimed at preserving volume have eroded profitability without stemming the market share loss.

While it’s fashionable to pin the blame on Elon Musk—his political antics, distractions with X, or erratic leadership—this sales slump is part of a much larger story. Tesla is no longer the scrappy underdog with bleeding-edge tech. It’s increasingly seen as expensive, stagnant, and outpaced by Chinese rivals innovating in real-time across every segment.

The Musk Problem?

It’s fair to ask whether Tesla’s drift from innovation is partly a Musk problem. Between political distractions, his obsession with X (formerly Twitter), and SpaceX’s ever-growing demands, it’s clear Tesla no longer receives his full attention—or his best thinking. For a company whose identity is so tightly tied to its founder, that loss of focus matters.

Worse, Musk seems to be fighting the wrong battles. His attention is locked on Western challengers like Waymo in the robotaxi race—interesting, but largely irrelevant in the face of Tesla’s far greater existential threat: China’s EV juggernauts. While Musk spars with software startups, companies like BYD, Zeekr, and Xiaomi are building ultra-competitive EVs at scale, with in-house FSD, batteries, and charging ecosystems that now outclass Tesla in critical areas.

And the numbers tell the story.

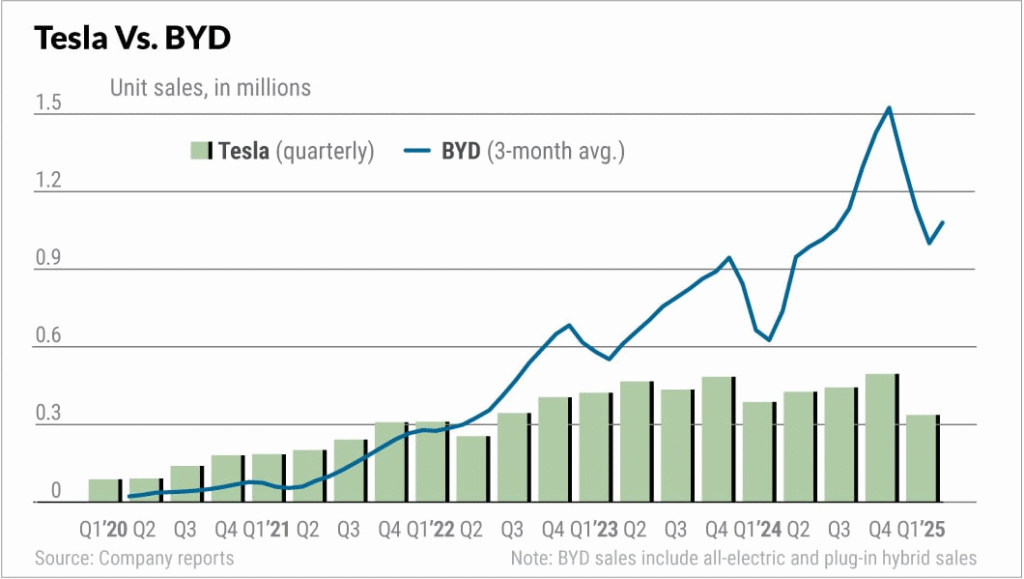

Tesla’s global sales have stagnated since early 2023, while BYD’s continue to surge. Even accounting for BYD’s inclusion of plug-in hybrids, the trend is clear: China’s leading EV maker is pulling away.

Musk once outmaneuvered legacy automakers by thinking differently. Now he risks becoming the very kind of slow-reacting incumbent he disrupted—distracted, outflanked, and fighting yesterday’s war.

Inevitable Decline—or Avoidable Misstep?

Stepping back: was this shift inevitable? Do all disruptors eventually settle into defense mode? Or is Tesla’s misstep unique—a failure of focus, strategy, or timing in the face of an accelerating global EV wave?

Some investors argue that margin protection is necessary in a post-growth phase. That’s a valid concern. But protecting profits means little if the product pipeline stagnates and brand relevance fades. You can’t cost-cut your way to reinvention.

Here’s the irony: disruptors become incumbents the moment they stop taking bold risks.

The Final Question

So the real question is: can Tesla reignite its disruptor DNA before it’s too late? Or has it already crossed the threshold into the same comfortable complacency it once exposed and defeated?

Because if the current trajectory holds, Tesla won’t just lose market share.

It’ll lose what made it matter in the first place.

Refrences:

Tesla’s Market Share Decline (2023-2024